ON MIKE’S MIND

We are always happy to see our friends succeed!

Especially when that success comes on the back of a big dream, endless grit, honesty and integrity - and just never giving up.

Darren Marble has long been the CEO of the equity crowdfunding platform Issuance - and has been an unflagging evangelist of the democratization of capital.

We are a longtime investor in Issuance, and in Darren. We spotted his hustle and his commitent to innovation early.

And we have been proven right.

As a denizen of Los Angeles, how could Darren not think…. “hmmmm -why not TV?”

How could he not think: “let’s showcase the opportunity to raise capital from customers, from fan bases, from the public by creating an unscripted show that demonstrates not only the opportunity, but also the ups and downs and the human drama of this growing form of raising capital.”

But here’s the kicker: he thought that if he created a show that is an “online” TV show, so to speak, “what if we made it possible for viewers to “click to invest - so they can invest in startups as they watch?”

Done!

His show, Going Public, created and produced with his partner Todd M. Goldberg, recently launched its third season.

And this time, with a difference — with a BANG!

Teaming up with X, which is one of the top 5 most visited sites online, Going Public just broke an “X Originals” record with over 16.3 million views tuning in to watch the show’s premiere.

Viewers are watching. And they are investing.

We will update you on the numbers as the season progresses.

Check out the show “Going Public” - https://www.goingpublic.com/ - and shoot Darren a Co/Investor Club congratulations on his hard work.

A pioneer in the democratization of capital, he is now the leading figure in proving that media too can be participatory, democratized and contributory to the growth of business and abundance in new and exciting ways.

Hats off to you, Darren!

To Our Friends and to Our Co/Success,

Mike

THE MARKETS

Trump certainly keeps the show entertaining, whether it’s wanting drug prices slashed, or demanding that Walmart and China eat the tariff costs

S&P 500: +0.91%, DJI: +0.99%, NASDAQ Composite: +0.38%

Jerome Powell spoke this week, saying rates could be higher for longer

The 2-year rose 11 basis points to 3.99, while the 10-year rose 7 basis points to 4.45

We did it! For the first time in 2025, we are in a greedy market

After last week’s incredible run, a small pullback was expected for crypto

BTC: -1.11%, ETH: -2.59%, XRP: -3.01%

WISE WORDS

"Figure out what works and do it. What are the factors that really govern the interests involved? What are the subconscious influences where the brain at a subconscious level is automatically doing these things?"

-Charlie Munger

GOT SOMETHING COOL IN THE WORKS?

A project you're building? A young company you’re supporting? An idea you're exploring? A wild investment thesis you can't stop thinking about?

We want to hear from YOU. Shoot us an email at cw@coinvestorclub.com —

We’re always looking to feature the best and brightest in the Co/Investor Club. We’ve got some serious investment intelligence within our ranks.

Share it.

Reflections on the Week…

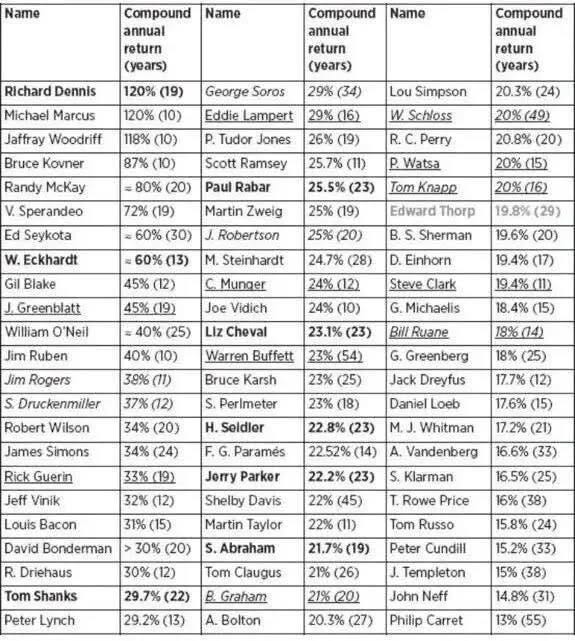

I came across this image over the past week and have become obsessed, 92 of the greatest investors to ever do it. All of them outperformed the S&P 500 for at least 10 years during their careers. Naturally, Warren Buffett stands out as the longest-running name on the list, boasting 54 years of outperformance at the time the list was created. But one name stood above the rest in terms of annualized returns: Richard Dennis, the Prince of the Pit

Richard Dennis's journey begins in 1956 as an order runner on the trading floor of the Chicago Mercantile Exchange. After a few years, he became determined to trade on his own.

He borrowed $1,600, spending $1,200 on a seat at the MidAmerica Commodity Exchange, and started trading with the remaining $400. Just 10 years later, he had turned this modest sum into over $1 million, eventually amassing a fortune exceeding $200 million through commodities trading.

At the core of Richard Dennis’s philosophy was the belief that price is truth.

He didn’t concern himself with forecasts or deep fundamental analysis—what mattered was how the market behaved in real time. Buy when prices break to new highs, sell when they break to new lows, and cut losses quickly. The edge wasn’t in prediction but in consistently executing a rules-based system that tilted the odds in your favor.

Dennis would’ve likely appreciated the spirit of the Efficient Market Hypothesis (EMH), not because he believed markets were unbeatable, but because he accepted that prices reflect all known information.

If the EMH says “you can’t outguess the market,” Dennis would have replied, “You don’t have to.” He didn’t try to disprove the market, he built a system that assumed prices were right and rode the emerging trends. His job wasn’t to interpret headlines, but to react to how markets responded.

Dennis believed this philosophy could be taught. To test his theory, he and William Eckhardt famously recruited a diverse group of individuals, some with no trading experience, and taught them his system in just two weeks. These were the now-famous Turtle Traders.

This group of 23 individuals, from a security guard to a game designer, was given $1 million of real capital to manage using Dennis’s trend-following system. The results were nothing short of extraordinary. Collectively, the Turtles generated over $175 million in profits in just five years. And their success didn’t fade with time.

Several Turtles went on to manage hedge funds and institutional portfolios, and the principles they learned, trend-following, risk control, and emotionless execution, remain foundational in quantitative strategies today.

I wonder if Richard Dennis would be just as successful in 2025 as he was 50 years ago. In many ways, he helped lay the foundation for modern trading, now shaped by AI, algorithms, and a constant stream of information.

The core of his approach, trend-following, volatility-based sizing, and rule-based execution, lives on in today’s quantitative strategies. But Dennis’s real edge wasn’t just the rules, it was the discipline to follow them.

While technology has changed, the hardest part remains unchanged: sticking to a system when it’s emotionally difficult. In an age of distraction, that kind of consistency is rarer than ever. As Dennis said,

“I always say you could publish my rules in the newspaper and no one would follow them. The key is consistency and discipline.”

The Savvy Investor…

Michael Burry Doubling Down on Estee Lauder

$1 Billion Already Spent, Investors Say “What’s One More Delay for GTA 6”

David Einhorn on European Stocks

Coinbase Replaces Discover on S&P

… and Coinbase Immediately Messes It Up

Publisher’s Note:

Sam Altman, CEO of OpenAI lays it out:

“You and I are living through this once-in-human-history transition where humans go from being the smartest thing on planet Earth to not the smartest thing on planet Earth.”

Like it or not, our human ego’s are going to have to get over it.

Are going to have to get humble - fast.

That may be a good thing. We may argue less with each other and like each other more.

We may just curl up and hide in our electronic caves and become passive consumers of content designed to pump dopamine into our systems.

We may, free from the need to calculate or do busywork, experience a renaissance of human creativity.

Personally, I think all of these things will happen, with varying degrees and with different people.

When it comes to trading and the markets, the truth - as written above - that the discipline of numbers, of algorithms will likely continue to gain respect in the minds of investors.

We all know basic rules like “don’t fight the Fed.”

Richard Dennis created his own rule, his own algorithm, and his ego-less, emotionless discipline created a fortune.

Several of them, apparently.

Here’s the fascinating question: how accurate is a mathematical algorithm that has to account for the ego, hope, fears and emotional swings of investors?

To answer that, I asked the smartest person I know… errr… the smartest intelligence I know, ChatGPT. Here’s what he/she/it/they concluded:

“A mathematical algorithm accounting for investor emotions like ego, hope, fears, and mood swings can achieve moderate accuracy in specific, short-term scenarios, particularly when supported by robust data and sophisticated modeling. However, it will never be fully accurate due to the chaotic, subjective, and unpredictable nature of human psychology. Such algorithms are best used as supplementary tools alongside fundamental and technical analysis, rather than standalone predictors. They can highlight trends or warn of potential overreactions, but they cannot fully "decode" the human heart.”

The chaos of the human heart lives on.

See you next week,

Adam

Publisher, The Co/Investor Club

If you have not already upgraded your membership…

Chat with Mike

Whether you’re an executive with investment opportunities or a college student looking to network, we would love to chat with you! Email our Founder, Mike Pruitt, at mp@coinvestorclub.com with questions and ideas or schedule a meeting.

Don’t forget to follow us on social media too!

LinkedIn: Co/Investor Club

For our disclaimer, please visit our website.

Have friends that want to join? The Co/Report is public, so feel free to share!

Thank you for reading. Co/Report grows through word of mouth. Please consider sharing this post with someone who might appreciate it.