Riding High

The S&P 500 and Dow fell from the all-time highs they reached at the end of last week, with the S&P 500 falling about 1% during the week and the Dow dropping about 2.7%. The Nasdaq, which touched an all-time high during Friday’s trading session, ended the week up about 0.2%.

It’s that time again. With stocks at or near all-time highs and some strange things happening—such as mega-cap Tesla moving up 22% on Thursday alone—it’s an excellent time to examine your portfolio and ensure you have the right balance of offense and defense for your emotions to handle the unpredictable future. As Howard Marks discussed in his most recent memo:

I’ve previously expressed my view that, as a starting point, every investor or their investment manager should identify their appropriate normal risk posture or offense/defense balance. For each individual or institution, this decision should be informed by the investor’s investment horizon, financial condition, income, needs, aspirations, responsibilities, and, crucially, intestinal fortitude, or their ability to stomach ups and downs.

Once investors have specified the normal risk posture that’s right for them, they face a choice: they can maintain that posture all the time, or they can opt to depart from it on occasion in response to the movements of the market and thus changes in the attractiveness of the offerings it provides, increasing their emphasis on offense when the market is beaten down and on defense when it’s riding high.

Markets and investor sentiment, at least regarding the major indices and the handful or two of stocks driving them, seem to be riding high once again. High valuations and high sentiment usually correlate with higher risk and lower returns eventually—although not always, and usually not immediately.

We can’t predict how things will unfold or how quickly. But we do think it’s important to be aware of the risks one is taking and to make sure they are the risks one wants to keep taking going forward.

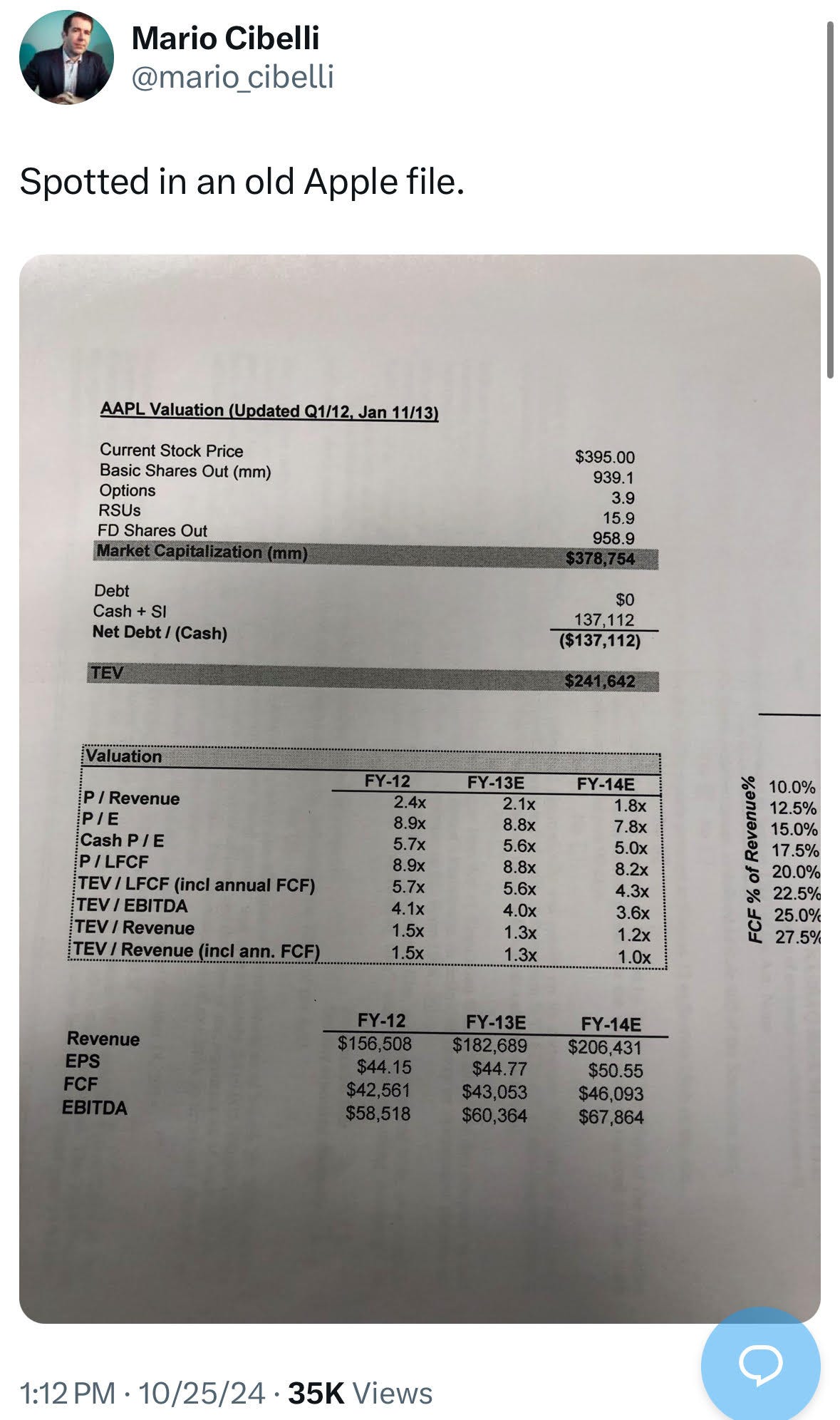

Tweets of the Week

In Case You Missed it…

Ruminating on Asset Allocation - by Howard Marks

The Inner Animal - by Sean Iddings

The Intelligent Investor at 75

The Intelligent Investor Rides Again w/ Jason Zweig (RWH050) (video)

Ask The Compound Podcast: How to Write with Morgan Housel

Joys of Compounding Podcast: The Art of Accel-ing

If you have not already upgraded your membership…

Avenel Financial Group, a merchant banking and advisory firm located in Charlotte, NC, launched a business venture called the Co/Investor Club. The Co/Investor Club is a community of value-oriented investors that collaborate on investment opportunities and ideas. You are receiving this newsletter because you are a Free or Premium Member of the Co/Investor Club!

Chat with Mike

Whether you’re an executive with investment opportunities or a college student looking to network, we would love to chat with you! Email our Founder, Mike Pruitt, at mp@coinvestorclub.com with questions and ideas or schedule a meeting.

Don’t forget to follow us on social media too!

Twitter: @coinvestorclub1

LinkedIn: Co/Investor Club

For our disclaimer, please visit our website.

Have friends that want to join? The Co/Report is public, so feel free to share!

Thank you for reading. Co/Report grows through word of mouth. Please consider sharing this post with someone who might appreciate it.