Static Arenas

Stock market indices had a mostly positive week. While the Nasdaq ended the week about where it started, the S&P 500 was up 0.6%, and the Dow was the biggest weekly winner with a 1.45% gain.

As seems to be the case every week, day, minute, and second, Nvidia saw headlines last week. Earlier on Thursday, the stock hit an all-time high, surpassing the market caps of Microsoft and Apple to become the market’s most valuable company—before turning lower on Thursday and again on Friday.

Nvidia is still up 155% year-to-date after being up a lot more in the years leading up to 2024. Whether it was undervalued at the start of the year or overvalued before becoming even more overvalued is something we’ll only know with hindsight.

We need a little more time for expectations and reality to meet in the future.

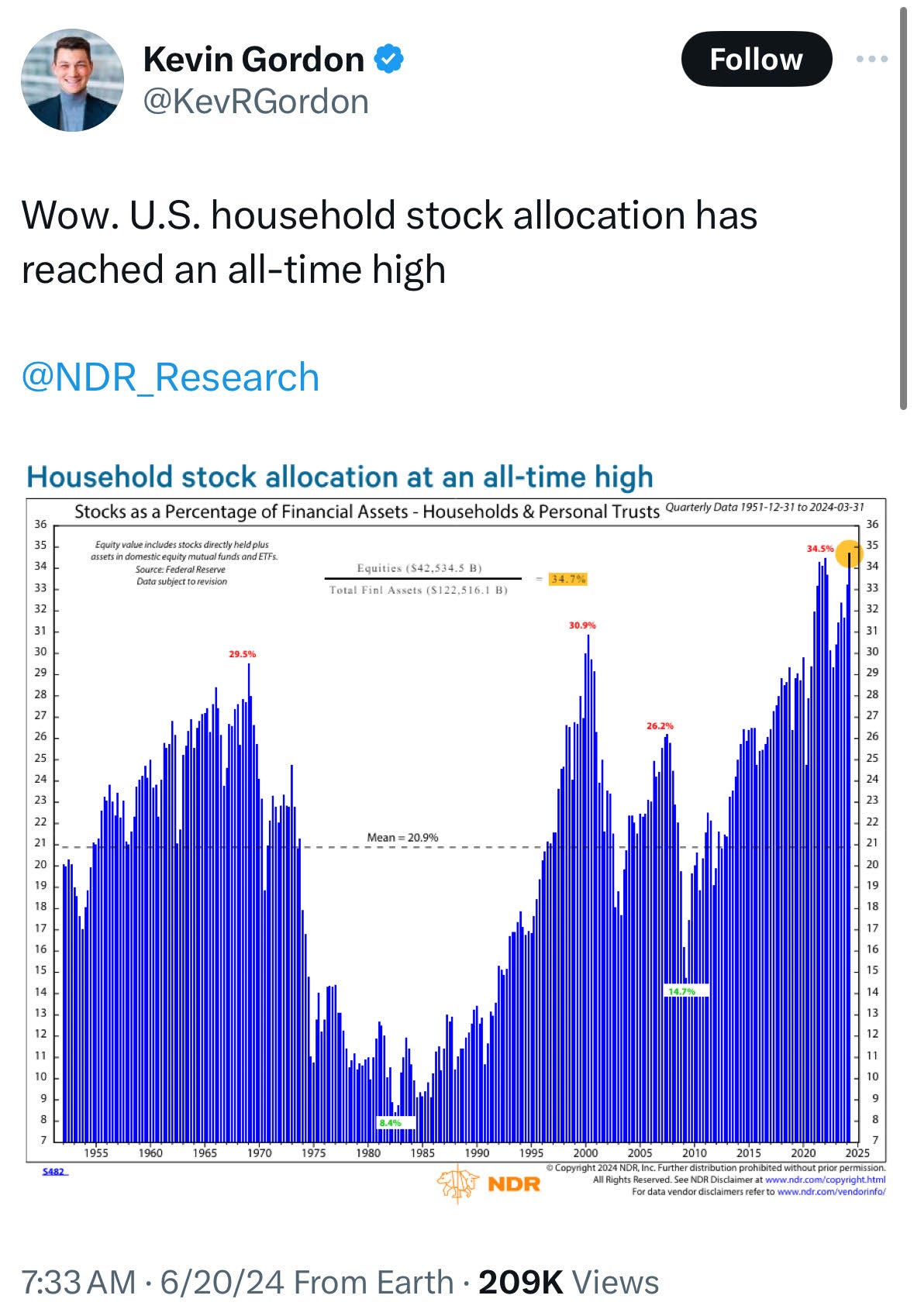

Whatever the case, investor behavior in bidding up the stock prices of certain companies has altered the landscape and future returns. Many well-known stocks have risen far faster than fundamentals. Future returns are altered by the fear and greed today—a process Howard Marks describes in his book The Most Important Thing:

Risk arises as investor behavior alters the market. Investors bid up assets, accelerating into the present appreciation that otherwise would have occurred in the future, and thus lowering prospective returns. And as their psychology strengthens and they become bolder and less worried, investors cease to demand adequate risk premiums. The ultimate irony lies in the fact that the reward for taking incremental risk shrinks as more people move to take it.

Thus, the market is not a static arena in which investors operate. It is responsive, shaped by investors’ own behavior. Their increasing confidence creates more that they should worry about, just as their rising fear and risk aversion combine to widen risk premiums at the same time as they reduce risk. I call this the “perversity of risk.”

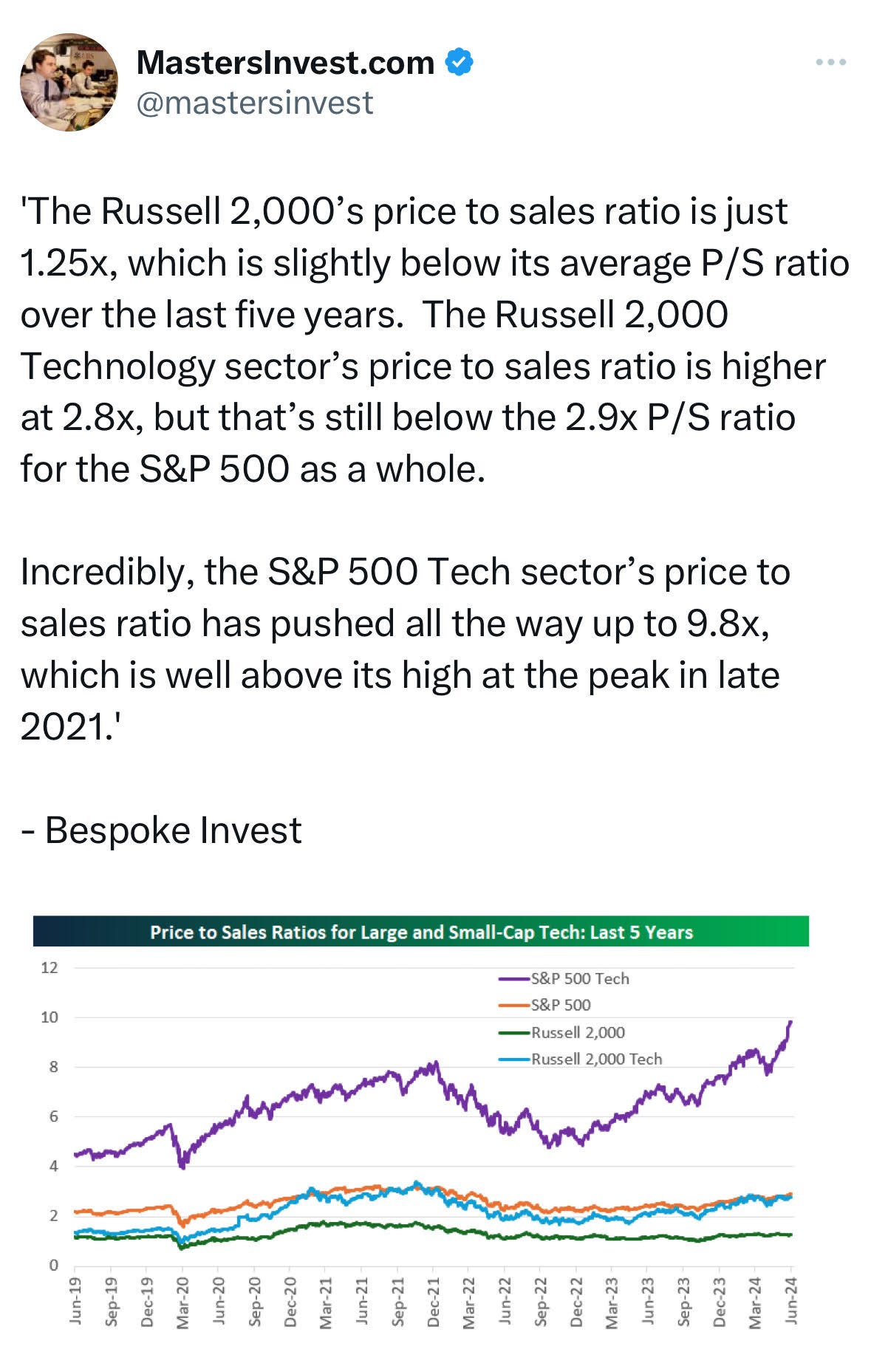

Much, if not most, of the market is priced high relative to a longer history. A lot of the market is priced reasonably if you consider the last five or ten years of history and ignore longer timeframes. But, somewhat surprisingly, we think, the larger technology companies are even beyond the valuations we saw in 2021.

Is it a new, new, new era or a time for some more extreme caution once again? Those big technology companies are now held by hundreds and hundreds of ETFs, target date funds, and just about everything else. So whatever the answer to the question might be, and whenever we’ll eventually find out, plenty of investors, pensioners, 401(k) participants, and others have a massive stake in the degree to which that answer will be positive or negative.

Tweets of the Week

In Case You Missed it…

Larry Cunningham on Buffett’s Investment Evolution (video)

Lessons from The Warren Buffett Way

Mohnish Pabrai's Session at The University of Nebraska, Omaha on May 3, 2024 (video)

Keynote Q&A with Bob Robotti at the Planet MicroCap Showcase (video)

Canadian MicroCaps in 2024 with Paul Andreola (video)

Going South: Implications of Business and Population Migration

Behind the Balance Sheet Podcast: #36 The Runner [with John Huber]

Masters of Scale Podcast: You could start a company this weekend, w/Noah Kagan

Planet MicroCap Podcast: LIVE in Vegas! With Artem Fokin, Ben Claremon, Sam Namiri, Michael Liu

Bulgogi Tacos, Fire Pits and Tequila Bars: Concertgoers Shell out for VIP Treatment- WSJ

If you have not already upgraded your membership…

Avenel Financial Group, a merchant banking and advisory firm located in Charlotte, NC, launched a business venture called the Co/Investor Club. The Co/Investor Club is a community of value-oriented investors that collaborate on investment opportunities and ideas. You are receiving this newsletter because you are a Free or Premium Member of the Co/Investor Club!

Chat with Mike

Whether you’re an executive with investment opportunities or a college student looking to network, we would love to chat with you! Email our Founder, Mike Pruitt, at mp@coinvestorclub.com with questions and ideas or schedule a meeting.

Don’t forget to follow us on social media too!

Twitter: @coinvestorclub1

LinkedIn: Co/Investor Club

For our disclaimer, please visit our website.

Have friends that want to join? The Co/Report is public, so feel free to share!

Thank you for reading. Co/Report grows through word of mouth. Please consider sharing this post with someone who might appreciate it.