The Co/Report is Sponsored by Pura Vida Investments

“Pura Vida Investments is putting the finishing touches on the 2022 yearling racing partnership. To date, we have spent $1,165,000 on eight yearlings. This package will spend up to $1,500,000 on yearlings. Composed of up to 12 racing prospects.

Three to four more yearlings will be added at public auctions in Ireland, England, and the US. The entire package of horses is being bought by the end of October.

This is the strongest group we’ve accumulated to date. Success of past ventures has allowed us to raise more capital. This allowed us to upgrade the quality of our purchases once again.

There is still room for a few more investors. That said, over a $1,000,000 has already been raised, and spots are filling quickly.” - Deuce Greathouse, Pura Vida Investments

Any prospective investors can feel free to contact Deuce Greathouse for any further information. (859)221-8033 or deucegreathouse@gmail.com

Co/Investor Club sponsored FORK Cancer - A Celebration of Life! FORK Cancer was hosted by Food & Beverage Social Club and was a collaboration of 15 Chefs on four courses to benefit four Cancer non-profits.

Thank you to everyone who attended and made a positive impact on the Charlotte Cancer community. We are excited to announce that your contributions have helped FORK Cancer raise $50,436 this year!

Up and Down

September showers seemed to bring October flowers at the beginning of the week, with the markets experiencing big gains on Monday and Tuesday. A significant portion of those gains was given back the rest of the week as investors saw what they’ve seen for much of 2022…. Volatility.

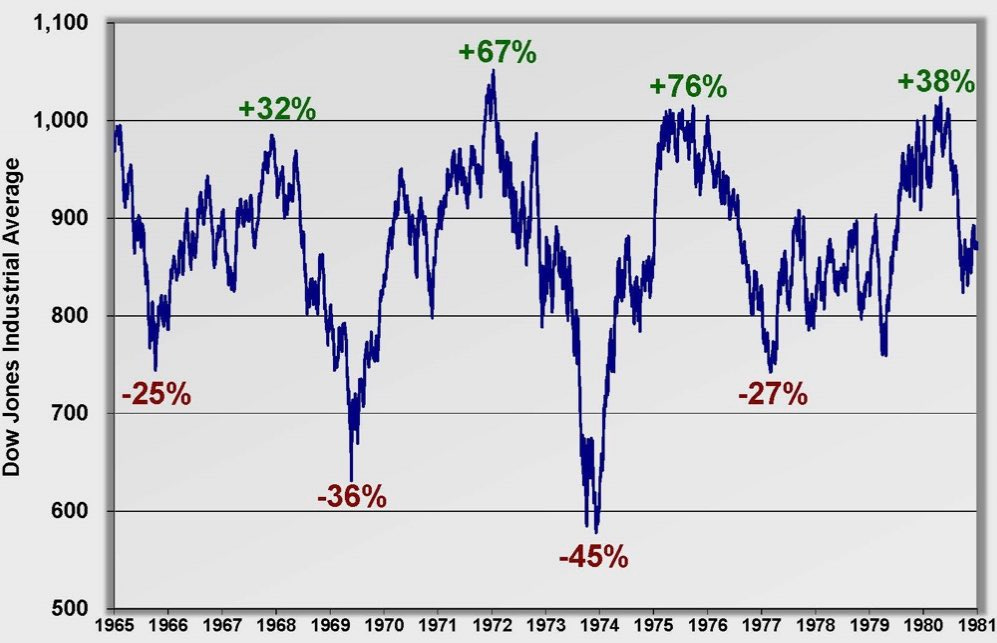

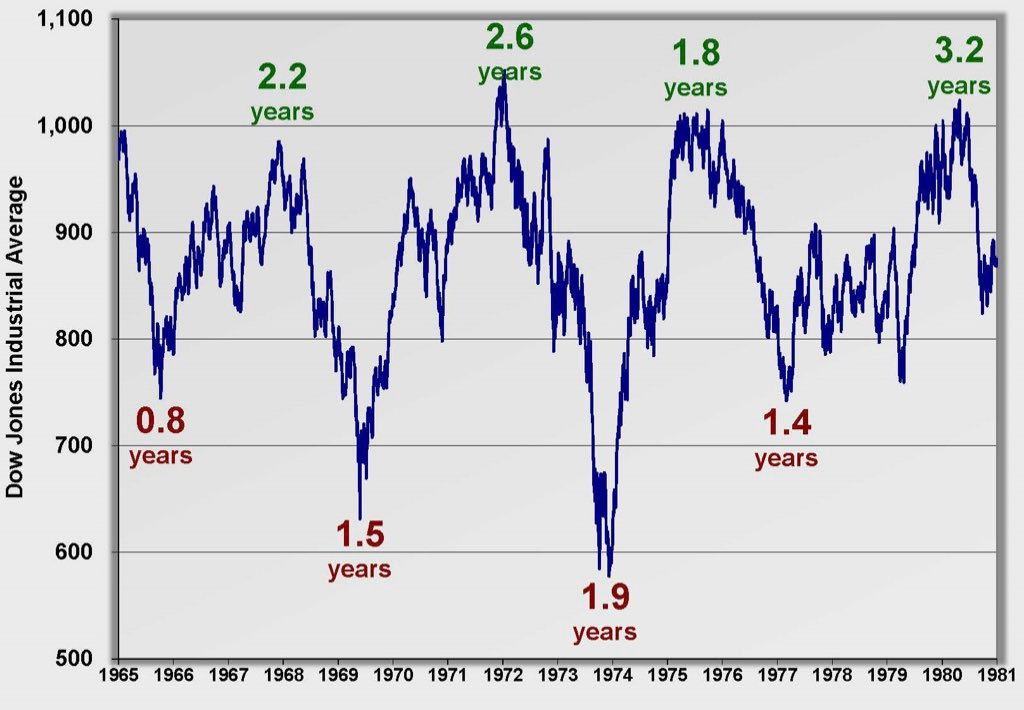

Stanley Druckenmiller recently suggested that maybe, just maybe, this market may resemble the type of market we saw from the late 1960s to early 1980s. As someone on Twitter illustrated, that timeframe looked a little like this:

There were rallies and downturns and ups and downs, and, in the end, we went about nowhere.

But there were things to do. It wasn’t a great time to be a passive investor—a type of investor more rare back then than today. But there were great and career-defining investments to be found for those active investors willing to take a long-term view.

For example, many of the investments Warren Buffett is best known for were made during this time. The acquisition of See’s Candies—which is credited for showing Buffett the merits of a quality business—happened in 1972. And he also made major public investments in Cap Cities, the Washington Post, and GEICO during this time.

In the midst of uncertainty and volatility, one of the greatest investors was able to help cement his place in history by buying businesses that compounded at high rates for years and decades.

The same is likely true today. Some of the all-time great investments are out there to be found and bought—those that allow you to buy right and just hold on without having to make another decision for years to come.

“The investor trying to buy right and hold on could buy as many different stocks as appealed to him. The difference is not in the focussing of investment money but in the intent of the buyer. The trader believes that in a swift-moving, rapidly changing world, with visibility always limited, he can make a series of commitments with better chance of success than trying to decide which companies will do well for the next twenty years. The investor dedicated to buying right and holding on picks managements, products, and processes he thinks able to cope with the unforeseeable as it hoves into view.” —Thomas Phelps (“100 to 1 in the Stock Market”)

Tweets of the Week

In Case You Missed It…

Expectations (Five Short Stories) - by Morgan Housel

Will the Stock Market Fall if Earnings Fall?

Richer, Wiser, Happier Podcast: The Quest For Resilient Wealth Creation w/ Matthew McLennan

Investing by the Books Podcast: #32 Christian Billinger on Investing for Growth

Here Are the Few Stock-Fund Managers Who Managed to Post Gains Over the Past Year

If you have not already upgraded your membership…

Avenel Financial Group, a merchant banking and advisory firm located in Charlotte, NC, launched a new business venture called the Co/Investor Club. The Co/Investor Club is a community of value-oriented investors that collaborate on investment opportunities and ideas. You are receiving this newsletter because you are a Free or Premium Member of the Co/Investor Club!

Chat with Mike

Whether you’re an executive with investment opportunities or a college student looking to network, we would love to chat with you!Email our Founder, Mike Pruitt, at mp@coinvestorclub.com with questions and ideas or schedule a meeting.

Don’t forget to follow us on social media too!

Twitter: @coinvestorclub1

LinkedIn: Co/Investor Club

For our disclaimer, please visit our website.

Have friends that want to join? The Co/Report is public, so feel free to share!

Thank you for reading. Co/Report grows through word of mouth. Please consider sharing this post with someone who might appreciate it.