Figures

“One can’t say that figures lie. But figures as used in financial arguments, seem to have the bad habit of expressing a small part of the truth forcibly, and neglecting the other part, as do some people we know.” —Fred Schwed Jr. (“Where Are the Customers’ Yachts?”)

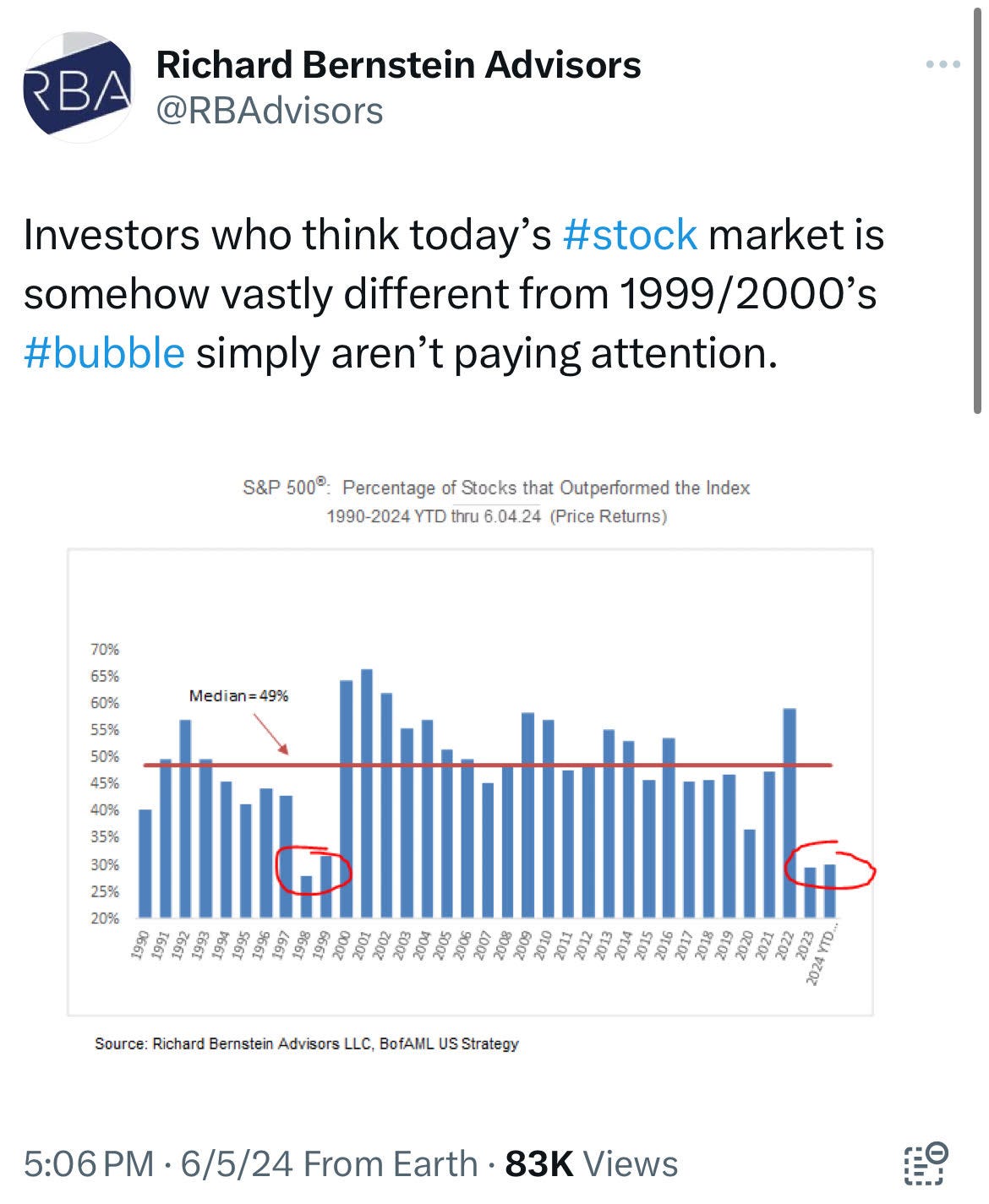

Stock market indices began the month of June off on a positive note. The S&P 500 was up 1.32% during the week, and the Nasdaq rose 2.38%.

We live in a world of financial adjustments. Companies adjust earnings to make their businesses look better—often in such extreme ways that one might mistake a bad business for a great business if one doesn’t dig in deep enough.

Investment bankers adjust earnings to make valuations and balance sheets more attractive to potential bag holders investors.

And people—investors and speculators alike—adjust the stories in their heads to make the numbers they see match what they already believe to be true.

And then some people make up stories about what one speculator might say or do to cause a price to go up higher for a bit, then a bit higher, and hopefully a little higher after that, as we saw with the return of the meme stock headlines this past week.

Market indices are hard to beat. However, the stock market will never be fully efficient thanks to the human factor governing its participants—and the emotions those humans can’t seem to keep from causing a little madness from time to time.

“It seems that the immature mind has a regrettable tendency to believe, as actually true, that which it only hopes to be true.” —Fred Schwed Jr. (“Where Are the Customers’ Yachts?”)

“What a man wishes, that also will he believe.” —Demosthenes

Tweets of the Week

In Case You Missed it…

Stock Market Concentration: How Much Is Too Much?

Robotti & Company Advisors’ First Quarter 2024 Letter

A Conversation with Citadel CEO Ken Griffin | Milken Institute Global Conference 2024 (video)

The Investing City Podcast: Ep. 110 - Mark Brooks: Tastes Like Chicken

Investing in Startups Podcast: E2: Chris Douvos on Backing Emerging Managers

Value Hive Podcast: Judd Arnold: Navios Maritime $NMM Deep Dive

Capitalisn’t Podcast: Capitalism-Was: What Happened to the American Dream? With David Leonhardt

If you have not already upgraded your membership…

Avenel Financial Group, a merchant banking and advisory firm located in Charlotte, NC, launched a business venture called the Co/Investor Club. The Co/Investor Club is a community of value-oriented investors that collaborate on investment opportunities and ideas. You are receiving this newsletter because you are a Free or Premium Member of the Co/Investor Club!

Chat with Mike

Whether you’re an executive with investment opportunities or a college student looking to network, we would love to chat with you! Email our Founder, Mike Pruitt, at mp@coinvestorclub.com with questions and ideas or schedule a meeting.

Don’t forget to follow us on social media too!

Twitter: @coinvestorclub1

LinkedIn: Co/Investor Club

For our disclaimer, please visit our website.

Have friends that want to join? The Co/Report is public, so feel free to share!

Thank you for reading. Co/Report grows through word of mouth. Please consider sharing this post with someone who might appreciate it.