All Over Again

“What has been will be again, what has been done will be done again; there is nothing new under the sun.” —Ecclesiastes

“Life starts all over again when it gets crisp in the fall.” —F. Scott Fitzgerald (“The Great Gatsby”)

October ended on Thursday of last week. While it was a down month, it was reasonably tame overall compared to some of the more famous Octobers in the stock market in years past. For the month, the S&P 500 was down 1%, the Nasdaq was down 0.5%, and the Dow lost 1.3%. November got off to a positive start with solid gains on Friday.

With the election this week, there is some heightened risk of volatility and, hopefully, a peak in both political rhetoric and unsolicited text messages to all of our cell phones.

Elections cause short-term noise, and what a president does can make a difference. But throughout the history of America, our system has proven sound enough to withstand both good and bad presidents—which is often the same person, depending on whom you ask. As Warren Buffett once said:

“I’ve said many times that you want to buy stock in a business that’s so good that an idiot can run it because sooner or later one will. And we live in a country, frankly, that is so good that your children and grandchildren will live a lot better than you live, even though an idiot or two runs it from time to time in between.”

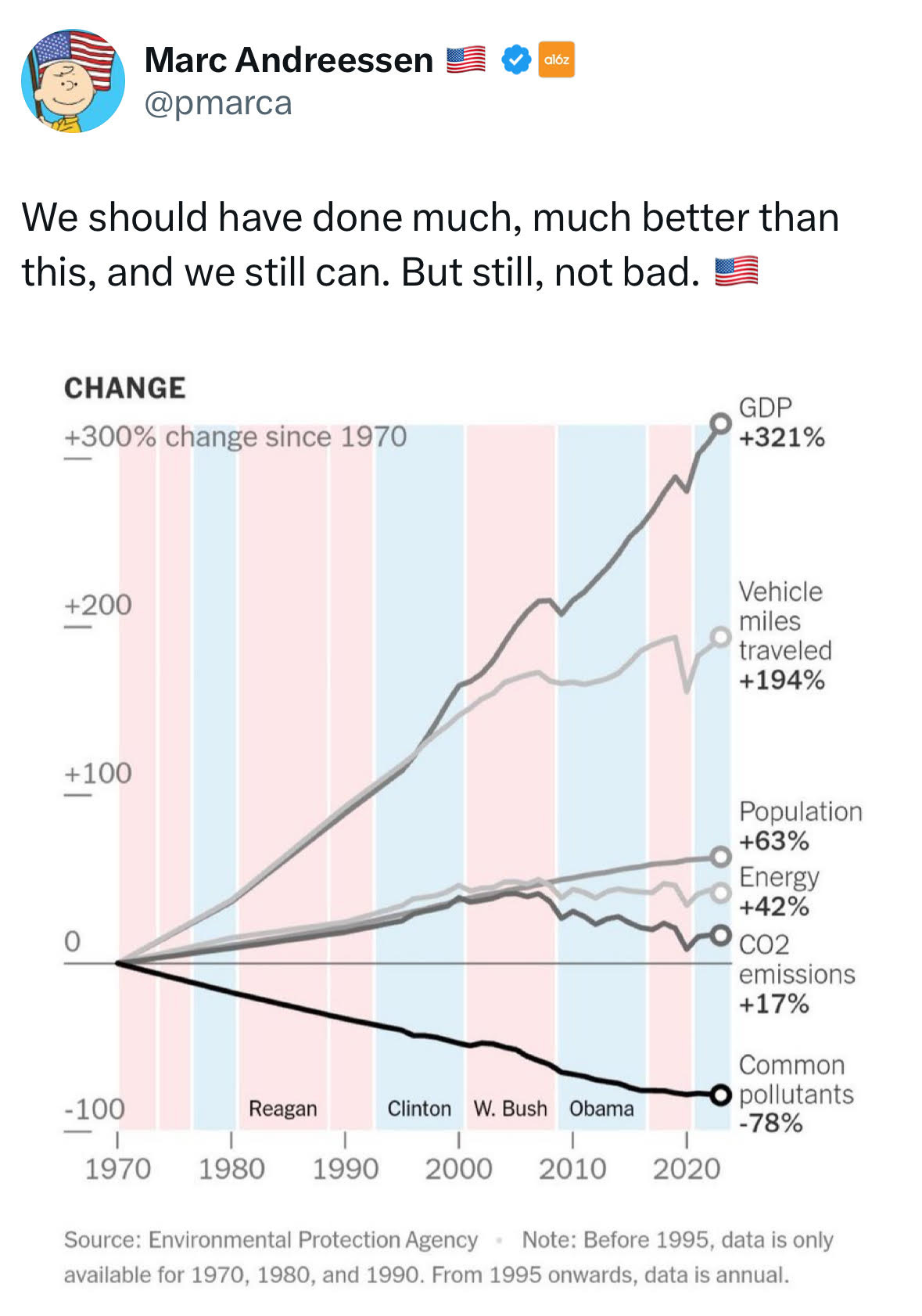

We do not hold a public opinion on which candidate would be better for our country, our economy, or our money. But we do think that, like so many times before, both the political and economic cycles will ebb and flow. Sometimes, we’ll like what we see. And sometimes we won’t.

Howard Marks has made this point about as well as anyone:

“I think it’s essential to remember that just about everything is cyclical. There’s little I’m certain of, but these things are true: Cycles always prevail eventually. Nothing goes in one direction forever. Trees don’t grow to the sky. Few things go to zero. And there’s little that’s as dangerous for investor health as insistence on extrapolating today’s events into the future.”

Whatever is happening within the broader landscape of our country and our economy, there will be ways to make money and ways to lose money. And so it will ever be.

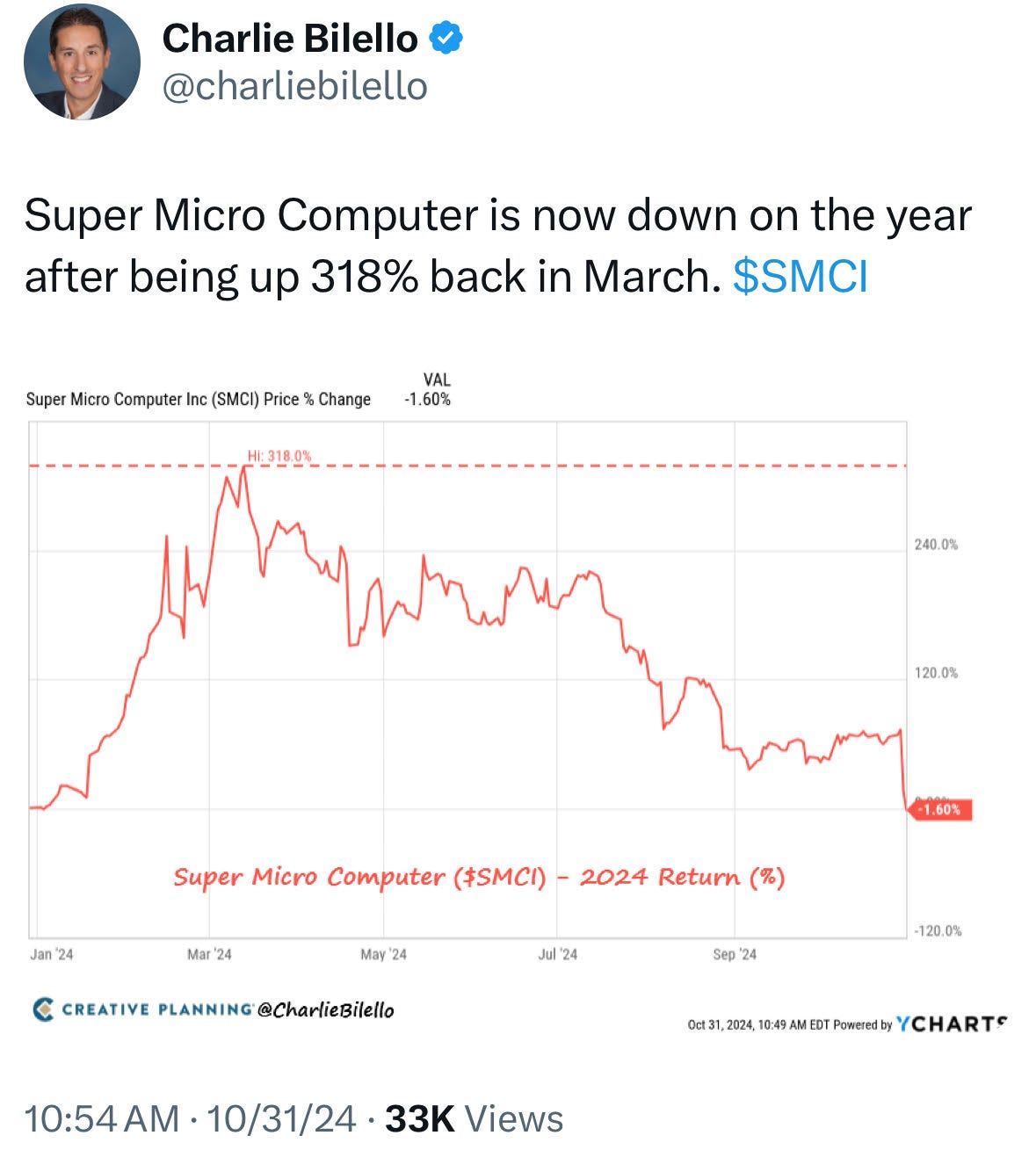

Tweets of the Week

In Case You Missed it…

Stock Picking is a Game of Self-Confidence - by Ian Cassel

The hard truth: Americans don’t trust the news media - by Jeff Bezos

David Einhorn Expects Inflation to Reaccelerate (video)

A Conversation with Grant Williams (video)

Why Acquire a Business?: A Home Service Acquisitions Series (video)

Capital Allocators Podcast: Ricky Sandler - Evolution of Long-Short Equity Investing

Nick Sleep’s Letters: The Founders Podcast

If you have not already upgraded your membership…

Avenel Financial Group, a merchant banking and advisory firm located in Charlotte, NC, launched a business venture called the Co/Investor Club. The Co/Investor Club is a community of value-oriented investors that collaborate on investment opportunities and ideas. You are receiving this newsletter because you are a Free or Premium Member of the Co/Investor Club!

Chat with Mike

Whether you’re an executive with investment opportunities or a college student looking to network, we would love to chat with you! Email our Founder, Mike Pruitt, at mp@coinvestorclub.com with questions and ideas or schedule a meeting.

Don’t forget to follow us on social media too!

Twitter: @coinvestorclub1

LinkedIn: Co/Investor Club

For our disclaimer, please visit our website.

Have friends that want to join? The Co/Report is public, so feel free to share!

Thank you for reading. Co/Report grows through word of mouth. Please consider sharing this post with someone who might appreciate it.