Controlling Risk

“Risk is about dealing with problems to which there is no certain solution.” —Peter Bernstein

While escalation in the Middle East and higher oil prices seemed to cause markets to decline early in the week, an end to the port strike and a strong September payroll report led to a rally on Friday. For the week, the S&P 500 was up 0.22%, the Nasdaq rose 0.1%, and the Dow was up 0.09%.

Stock markets have had a good year. The S&P 500, for example, was up about 21% through the first three quarters of the year, which ended early last week.

As we’ve seen several times in the last several years, the “Magnificent 7” once again led the way. As a group, they are up about 35% this year and account for 45% of the S&P 500’s return. This follows a return of 76% in 2023, as those seven stocks contributed 63% of the S&P 500’s 24% return last year. Once again, large-cap growth stocks have continued to trounce small-cap value stocks.

How long can this run of strong market returns continue? And what might cause it to end?

It’s hard to say. Turning points are hard to call. In 2022, higher inflation and rising interest rates seemed to be the catalyst. But in other times, like the year 2000, there is far less of a definitive catalyst. Sometimes, the world just realizes that trees can’t grow to the sky.

As an investor, earning good returns while controlling risk so that you’re ready for the eventual turn is a mark of skill. As Howard Marks has written:

Controlling risk is the mark of a professional. Anybody can make money when the market goes up. And most of the time the market goes up. And anybody who takes above-average risk can do above average when the market rises. So achieving returns is not a point of distinction in good times. In my opinion, the distinction of a superior investor is achieving returns in good times with the risk under control, because you never know when the environment is going to shift from favorable to unfavorable. And the question is: are you prepared?

Maybe the current set of risks making headlines will cause that shift. Or maybe it’ll be some other set of risks. But whichever ends up being the case, the things you do today will have you either prepared or unprepared for the eventual turn to less favorable times.

“Risk in our world is nothing more than uncertainty about the decisions that other human beings are going to make and how we can best respond to those decisions.” —Peter Bernstein

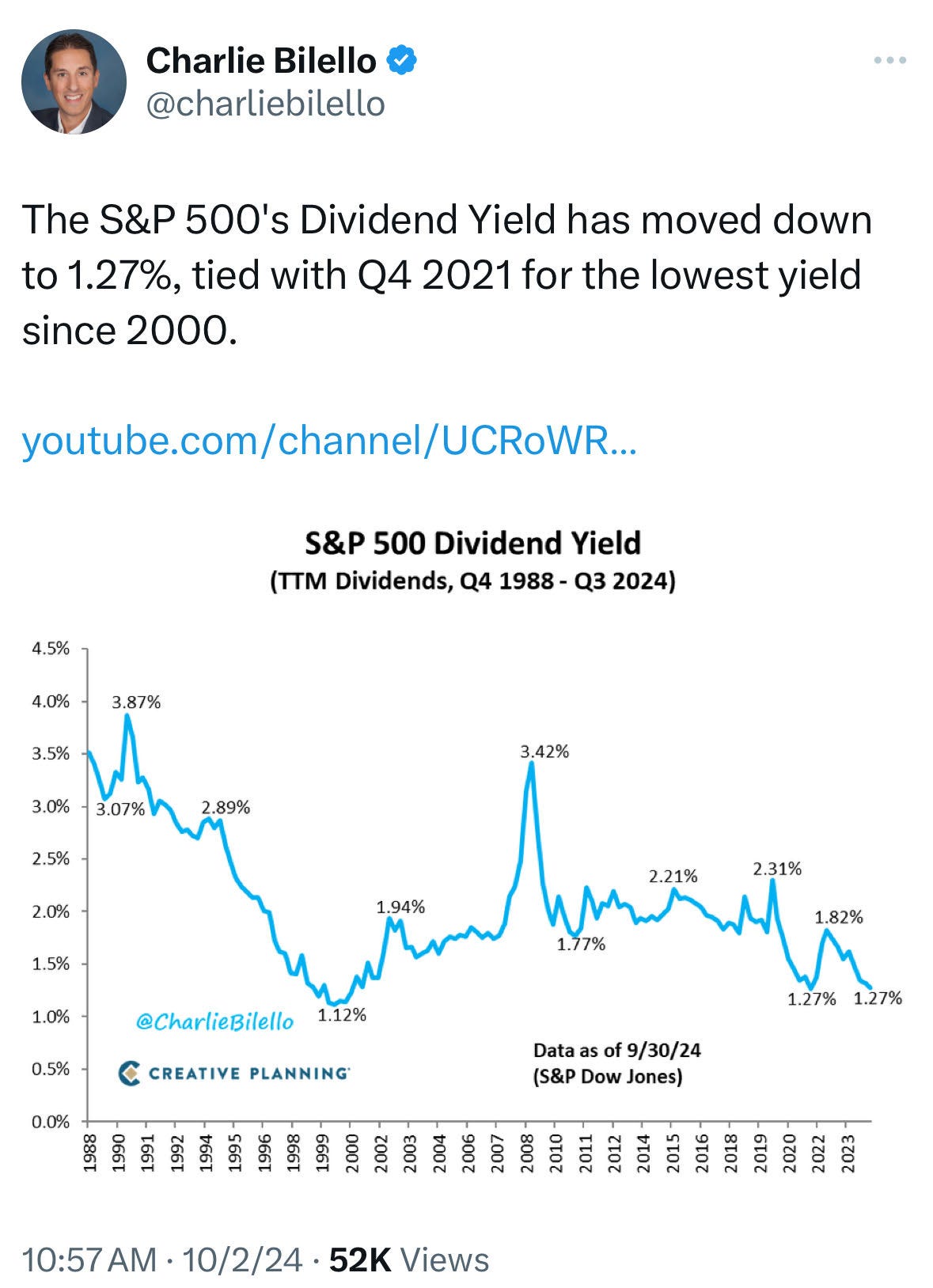

Tweets of the Week

In Case You Missed it…

J.P. Morgan Asset Management’s 4Q Guide to the Markets

Bill Ackman’s slides from a talk he gave about Harvard

Avoiding the ‘Uh-Oh’ Moments - by Adam Wilk

The Intentional Investor Show: Drew Dickson (video)

Why This Investor Doesn’t Just Dabble In the Market: Brad Gerstner Reveals His Strategies (video)

3 Things (with Ric Elias) Podcast: Technology vs Presence (Patrick O'Shaughnessy)

The Knowledge Project Podcast: The Blueberry Billionaire | John Bragg

Dwarkesh Podcast: Daniel Yergin – Oil Explains the Entire 20th Century

All In Podcast: John Mearsheimer and Jeffrey Sachs | All In Summit

If you have not already upgraded your membership…

Avenel Financial Group, a merchant banking and advisory firm located in Charlotte, NC, launched a business venture called the Co/Investor Club. The Co/Investor Club is a community of value-oriented investors that collaborate on investment opportunities and ideas. You are receiving this newsletter because you are a Free or Premium Member of the Co/Investor Club!

Chat with Mike

Whether you’re an executive with investment opportunities or a college student looking to network, we would love to chat with you! Email our Founder, Mike Pruitt, at mp@coinvestorclub.com with questions and ideas or schedule a meeting.

Don’t forget to follow us on social media too!

Twitter: @coinvestorclub1

LinkedIn: Co/Investor Club

For our disclaimer, please visit our website.

Have friends that want to join? The Co/Report is public, so feel free to share!

Thank you for reading. Co/Report grows through word of mouth. Please consider sharing this post with someone who might appreciate it.