Leaders and Laggards

“Whenever you can, you try to invest in the best just as long as you don’t overpay. The world-class operator never goes out of business, generally has an impregnable balance sheet to weather recessions, and is the first to come back in an economic recovery. The dominant player also stands as the buyer of last resort for prime properties that come on the market.” —Martin Sosnoff (“Silent Investor, Silent Loser”)

Stock market indices were up again last week and are now all positive for 2024. After flirting with the level several times, the S&P 500 finally surpassed the all-time high closing level for the first time since January 4, 2022.

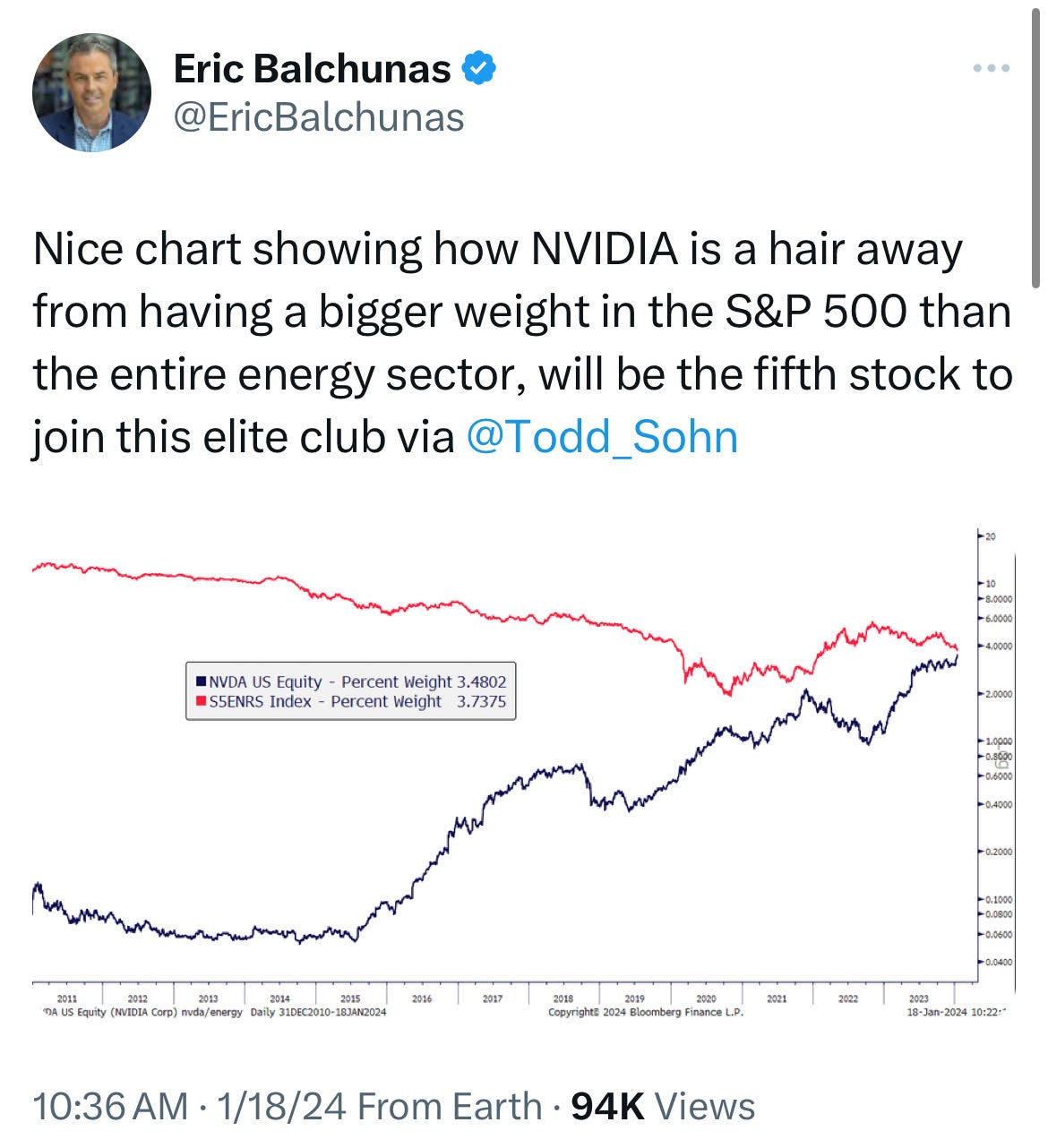

Technology continues to lead the way in the market, and the Fed continues to lead the way when it comes to headlines in the financial news. Guessing what the Fed will do better than others is a challenging game to play—and an even more challenging way to try and make money. And while trying to find good companies at reasonable prices isn’t easy, at least you have time on your side. If you’re right about a business being good, you can be a little wrong buying your shares at a high-ish multiple.

But not too wrong and not too high of a multiple. Many of the technology names that get the headlines have a whole lot of optimism priced into their stocks. Yes, they have good competitive positions within their industries, but to make above-average returns, they’ll have to perform even better than those expectations.

But other companies in other parts of the economy also have good competitive positions that aren’t trading near 52-week highs. For example, there are several names within the Consumer Staples, Consumer Discretionary, and Energy sectors with some competitive advantages that are trading within shouting distance of their 52-week lows, such as those in the table below:

While we hold no public opinion on the names above and have a special affinity for smaller stocks within these spaces, we think it’s an interesting place to look. In a market that has seen such a significant divergence between the haves and the have-nots, there is bound to be, maybe, possibly, an eventual reversion to the mean somewhere.

“If you believe the story everyone else believes, you’ll do what they do. Usually you’ll buy at high prices and sell at lows. You’ll fall for tales of the ‘silver bullet’ capable of delivering high returns without risk. You’ll buy what’s been doing well and sell what’s been doing poorly. And you’ll suffer losses in crashes and miss out when things recover from bottoms. In other words, you’ll be a conformist, not a maverick; a follower, not a contrarian.” —Howard Marks

Tweets of the Week

In Case You Missed it…

LiveRamp Acquires Habu to Accelerate Data Collaboration with Enhanced Clean Room Technology

Information That Would Get Your Attention - by Morgan Housel

The Global Hunt for Great Stocks w/ Laura Geritz (video)

What is the Historical Rate of Return on Housing?

Technology in a Turbulent World | Davos 2024 | World Economic Forum (video)

If you have not already upgraded your membership…

Avenel Financial Group, a merchant banking and advisory firm located in Charlotte, NC, launched a business venture called the Co/Investor Club. The Co/Investor Club is a community of value-oriented investors that collaborate on investment opportunities and ideas. You are receiving this newsletter because you are a Free or Premium Member of the Co/Investor Club!

Chat with Mike

Whether you’re an executive with investment opportunities or a college student looking to network, we would love to chat with you! Email our Founder, Mike Pruitt, at mp@coinvestorclub.com with questions and ideas or schedule a meeting.

Don’t forget to follow us on social media too!

Twitter: @coinvestorclub1

LinkedIn: Co/Investor Club

For our disclaimer, please visit our website.

Have friends that want to join? The Co/Report is public, so feel free to share!

Thank you for reading. Co/Report grows through word of mouth. Please consider sharing this post with someone who might appreciate it.