Checklists

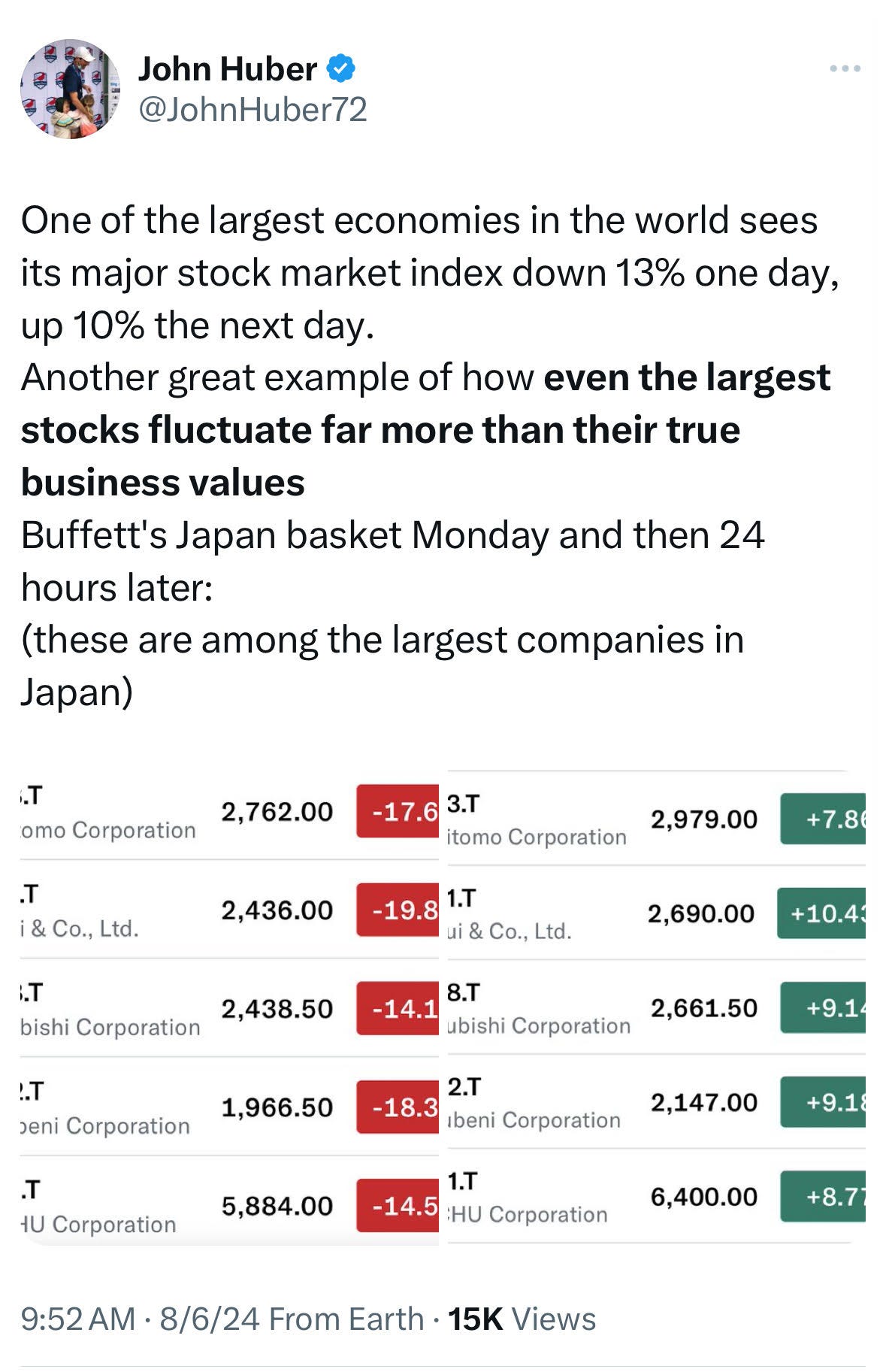

After a week that started with heavy losses on Monday, which included a drop of over 1,000 points on the Dow, the market rallied back and ended the week with modest losses. For the week, the S&P 500 was down just 0.04%, the Nasdaq fell 0.18%, and the Dow ended up down 0.6%.

These days, constant access to news and, maybe more importantly, other people’s opinions make it easy for one’s mind to ebb and flow about this investment or that investment—just as the stock market ebbs and flows. One way to possibly make better investment decisions is with a checklist to help you add more discipline and consistency to your investment process. As Jason Zweig wrote in an article back in 2013:

By building a checklist—a standardized set of questions you must answer before you commit to any investment decision—you can reduce the risk of making costly errors. The best way to do that is by looking at your past mistakes. That's true no matter how you invest, even if you don't buy individual stocks at all.

The idea, still surprisingly underused in the investment business, is adapted from hospitals and the airline industry. An itemized list of procedures and how to follow them, the surgeon Atul Gawande has written, can "hold the odds of doing harm low enough for the odds of doing good to prevail."

Checklists help fix one of the biggest flaws in the way investors make decisions: inconsistency.

An increase in uncertainty tends to create volatility, which creates opportunities to make good and bad decisions. In the quiet calm of early morning, late evening, or maybe after a long walk, it might be useful to get out a pen and paper and write down a simple checklist covering a few rules you’ll commit to adhering to during this next phase of the market and economic cycle.

“The fluctuating emotions and irrational behaviors governing human activity ensure that markets will always be inefficient and mispricings will always exist. But those inefficiencies will not be constant in number or magnitude. The availability of investment opportunity will remain a cyclical phenomenon, both ebbing and flowing. Moreover, in the complex dance of the market, where psychology mingles with economic and business fundamentals, today’s ebb can actually precipitate tomorrow’s flow.” —Seth Klarman

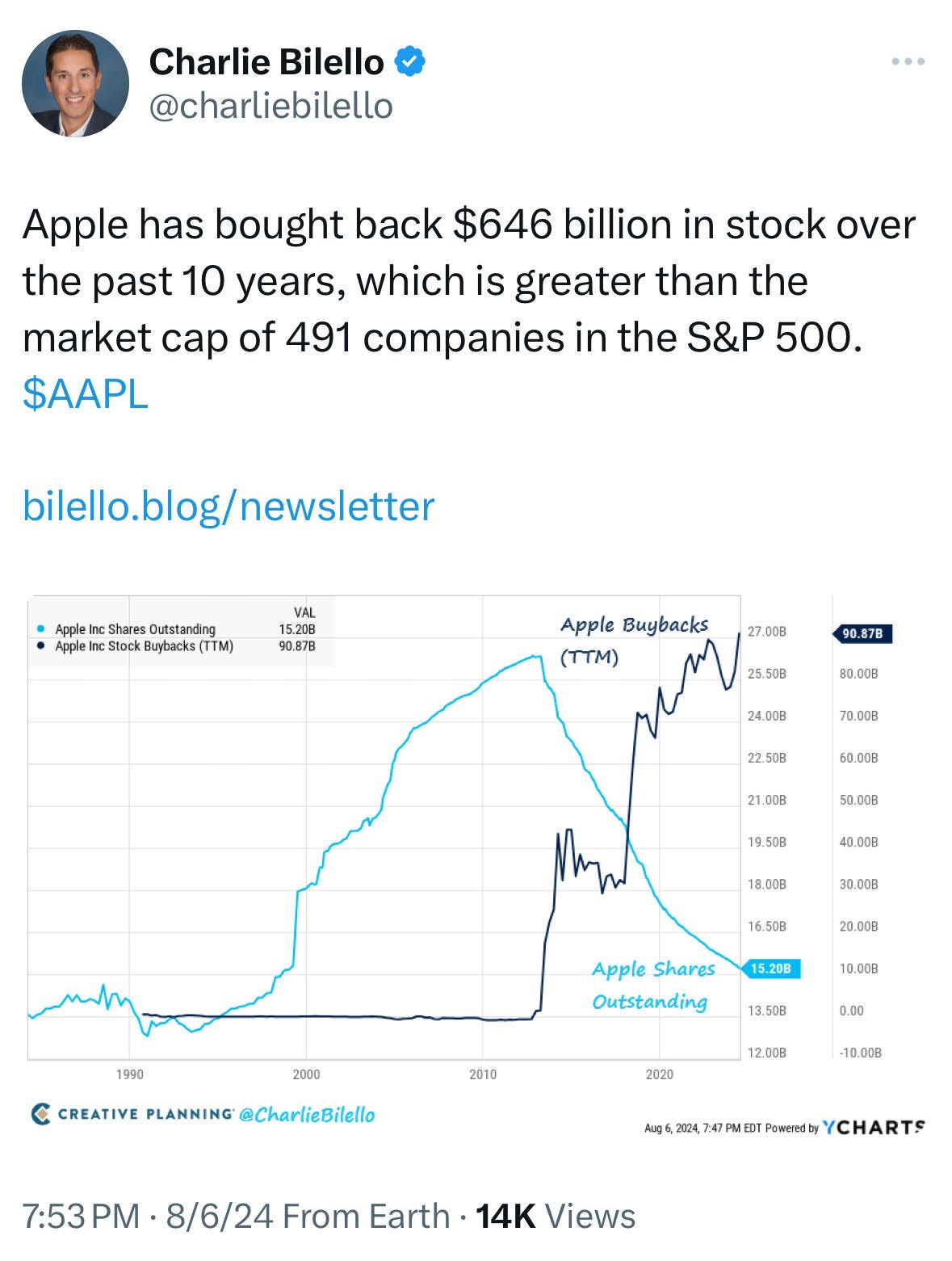

Tweets of the Week

In Case You Missed it…

My 8 Key Rules For Investing & Refining The Checklist Process | Guy Spier (video)

The Story of LHC Group by co-founder Keith Myers (video)

We Will Find You - by Adam Wilk

Bruce Berkowitz - Avoiding Disaster and Generating Returns While Doing So (video)

A Few Little Ideas And Short Stories - by Morgan Housel

These already cheap value stocks are on sale right now

Business Breakdowns Podcast: Siemens Energy: Winds of Change

How to Take Over the World Podcast: Nike Founder Phil Knight

A Letter a Day: Letter #206: Padraig Harrington (2023)

If you have not already upgraded your membership…

Avenel Financial Group, a merchant banking and advisory firm located in Charlotte, NC, launched a business venture called the Co/Investor Club. The Co/Investor Club is a community of value-oriented investors that collaborate on investment opportunities and ideas. You are receiving this newsletter because you are a Free or Premium Member of the Co/Investor Club!

Chat with Mike

Whether you’re an executive with investment opportunities or a college student looking to network, we would love to chat with you! Email our Founder, Mike Pruitt, at mp@coinvestorclub.com with questions and ideas or schedule a meeting.

Don’t forget to follow us on social media too!

Twitter: @coinvestorclub1

LinkedIn: Co/Investor Club

For our disclaimer, please visit our website.

Have friends that want to join? The Co/Report is public, so feel free to share!

Thank you for reading. Co/Report grows through word of mouth. Please consider sharing this post with someone who might appreciate it.