Wild Things

Market indices had a volatile week, highlighted by big drops on Wednesday—the S&P 500 was down 2.31% that day, and the Nasdaq fell 3.64%—and then a rally on Friday to claw back some of that loss. For the week as a whole, the S&P 500 fell 0.8%, and the Nasdaq was down 2.1%. After a gain of 654 points on Friday, the Dow finished the week with a positive 0.8% return.

Markets move, and narratives change. Often, markets are mostly efficient—and sometimes, they are vastly inefficient. As Warren Buffett said at the 2000 Berkshire Hathaway Annual Meeting:

We generally believe you can just see anything in markets. I mean, it's just extraordinary what happens in markets over time. It gets sorted out eventually, but we have seen companies sell for tens of billion dollars that are worthless. And at times, we have seen things sell for...literally 20 percent or 25 percent of what they were worth. So we have seen and will continue to see everything. It’s just the nature of markets. They produce wild, wild things over time. And the trick is, occasionally, to take advantage of one of those wild things and not to get carried away when other wild things happen because the wild things create their own truth for a while.

We, nor anyone else, know for sure if last week's volatility will continue or become more extreme. But if things get wild, those who don’t get carried away can take advantage of them, as Mr. Buffett has done so many times in the past.

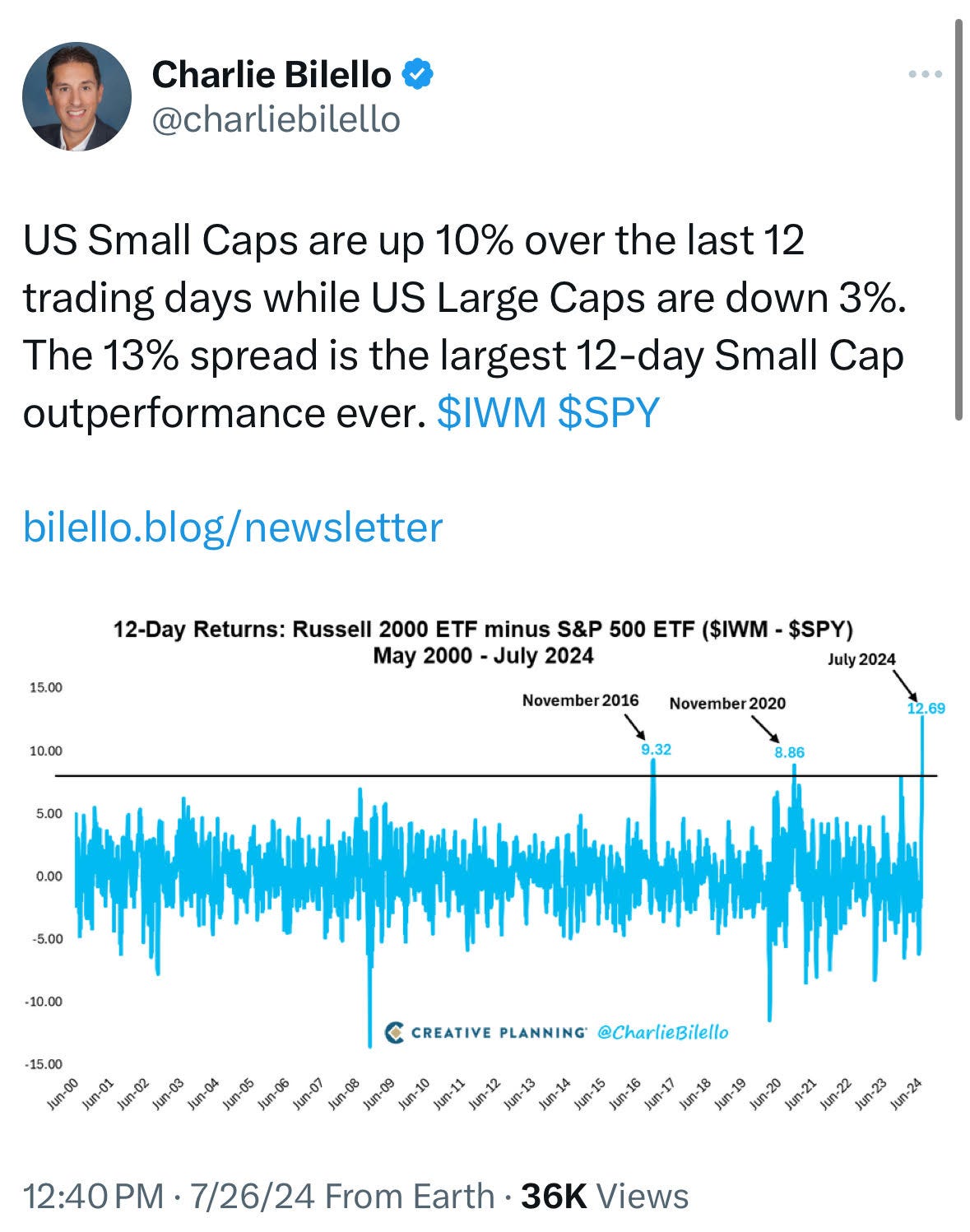

Tweets of the Week

In Case You Missed it…

Which One Is It? Equity Issuance and Retirement - by Michael Mauboussin and Dan Callahan

Crashes and Competition - by Ben Thompson

A Bit of Optimism Podcast: Mastery is an Infinite Game with performance psychologist Mike Gervais

If you have not already upgraded your membership…

Avenel Financial Group, a merchant banking and advisory firm located in Charlotte, NC, launched a business venture called the Co/Investor Club. The Co/Investor Club is a community of value-oriented investors that collaborate on investment opportunities and ideas. You are receiving this newsletter because you are a Free or Premium Member of the Co/Investor Club!

Chat with Mike

Whether you’re an executive with investment opportunities or a college student looking to network, we would love to chat with you! Email our Founder, Mike Pruitt, at mp@coinvestorclub.com with questions and ideas or schedule a meeting.

Don’t forget to follow us on social media too!

Twitter: @coinvestorclub1

LinkedIn: Co/Investor Club

For our disclaimer, please visit our website.

Have friends that want to join? The Co/Report is public, so feel free to share!

Thank you for reading. Co/Report grows through word of mouth. Please consider sharing this post with someone who might appreciate it.