Businesses and Businessmen

“You want to really devote as much time as possible to study the history of businesses and the history of great businessmen in the past.” —Li Lu

Post-election optimism returned to the stock market this past week, with the S&P 500 and Nasdaq rising about 1.7% and the Dow rising about 2%.

The highest returns usually come from finding great companies early—before they are great. So many of us are looking for that in the stock market. We want to invest early in the big winners of the future.

But that’s not easy. It usually takes great businessmen and a lot of luck for a small company to become a big business. So we study history to try and help us understand past examples, hoping we’ll gain some knowledge to help us in the future.

In studying history, we also realize that sometimes, already great businesses get overlooked. Maybe they are thought to be in decline and won’t be great businesses in the future. Or maybe they are just in an industry or sector that is out of favor with the majority of the investing public.

We don’t make stock recommendations in this newsletter, but to give an example of a potential company that may fit the example above, consider Nestlé. It’s on the list of names we look at near 52-week lows. It has an average return on invested capital since 1990 north of 13%, has diversified its product line over time, has a trailing dividend yield approaching 4%, and is trading at a forward P/E ratio just under 17x—lower than the overall market, and at just about the lowest multiple in a decade.

Maybe it’ll be a good investment from here, and maybe not. But in this bifurcated market, there are a lot of companies that look like they are better than the average S&P 500 company from a quality perspective—which are also available at better valuations. Maybe we’re once again about to enter a stock-picker’s market going forward?

“There is no better teacher than history in determining the future. There are answers worth billions of dollars in a $30 history book.” —Charlie Munger

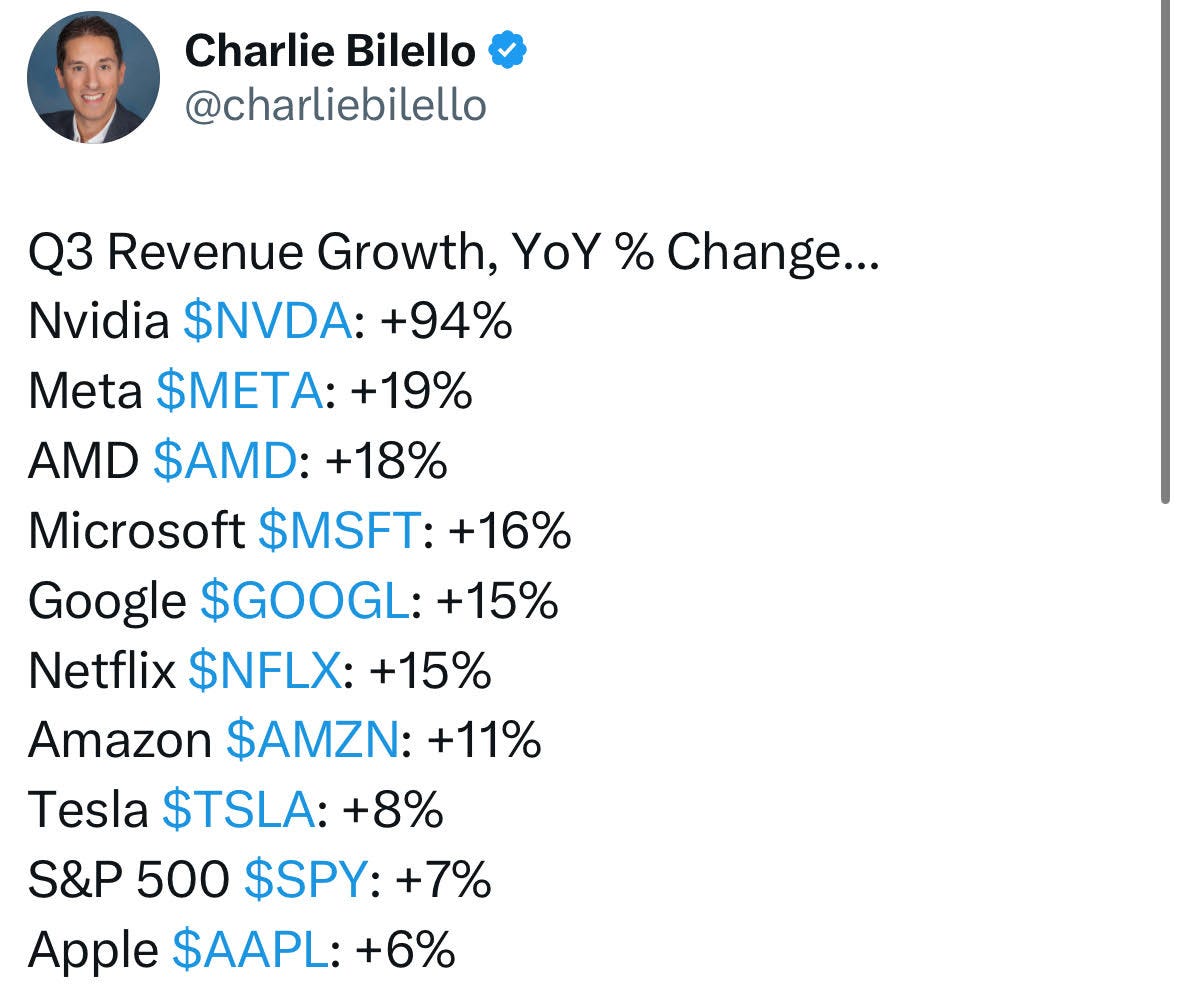

Tweets of the Week

In Case You Missed it…

Please take a moment to read an article about our founder, Mike Pruitt, and his 319 Golf Society charity! (Link)

Good Business Great Stock - by Ian Cassel

A Chance to Build - by Ben Thompson

Mohnish Pabrai's Guest Lecture at University of Nebraska, Omaha on October 15, 2024 (video)

Founders Podcast: #371 James J. Hill: The Empire Builder

Capital Allocators Podcast: Scott Bessent - Macro Maven

Alliance Entertainment Holding Corp (AENT) - Fall 2024 Investor Presentation

If you have not already upgraded your membership…

Avenel Financial Group, a merchant banking and advisory firm located in Charlotte, NC, launched a business venture called the Co/Investor Club. The Co/Investor Club is a community of value-oriented investors that collaborate on investment opportunities and ideas. You are receiving this newsletter because you are a Free or Premium Member of the Co/Investor Club!

Chat with Mike

Whether you’re an executive with investment opportunities or a college student looking to network, we would love to chat with you! Email our Founder, Mike Pruitt, at mp@coinvestorclub.com with questions and ideas or schedule a meeting.

Don’t forget to follow us on social media too!

Twitter: @coinvestorclub1

LinkedIn: Co/Investor Club

For our disclaimer, please visit our website.

Have friends that want to join? The Co/Report is public, so feel free to share!

Thank you for reading. Co/Report grows through word of mouth. Please consider sharing this post with someone who might appreciate it.