Too Hard

“There’s a lot of things in financial markets I don’t understand. And that doesn’t mean I have to make a decision.” —Warren Buffett

After the big post-election bump last week, the stock market took a bit of a breather. The S&P 500 was down slightly over 2% during the week, and the Nasdaq dropped slightly over 3%.

Will the incoming U.S. Administration's policies be inflationary? Will they ignite growth and economic activity? Will interest rates continue to creep back up or decline if inflation remains subdued?

These questions are important but hard to answer. Economics was already nicknamed “the dismal science” before politics and egos were added to the equation.

But you don’t have to make investment decisions based on these hard questions. You can wait for easier things to come your way.

As Warren Buffett said at the 2005 Berkshire Hathaway Annual Meeting:

There are things in life that you don’t have to make a decision on and that are too hard.

And many years ago on one of the reports, I said one of the interesting things about investment is that there’s no degree of difficulty factor.

I mean, if you’re going to go diving in the Olympics and try to win a gold medal, you get paid more, in effect, for certain kinds of dives than others because they’re more difficult. And they properly adjust for that factor.

But in terms of investing, there is no degree of difficulty. If something is staring you right in the face and the easiest decision in the world, the payoff, can be huge. And we get paid, not for jumping over 7-foot bars, but for stepping over 1-foot bars.

And the biggest thing we have to do is decide which ones are the 1-foot bars and which ones are the 7-foot bars so when we go to step we don’t bump into the bar.

Sitting tight and waiting for easy decisions isn’t always exciting, but it’s often the most profitable thing to do in the long run.

“It was never my thinking that made the big money. It was always my sitting. Men who can both be right and sit tight are uncommon. I found it one of the hardest things to learn. But it is only after a stock operator has firmly grasped this that he can make big money.” —Jesse Livermore

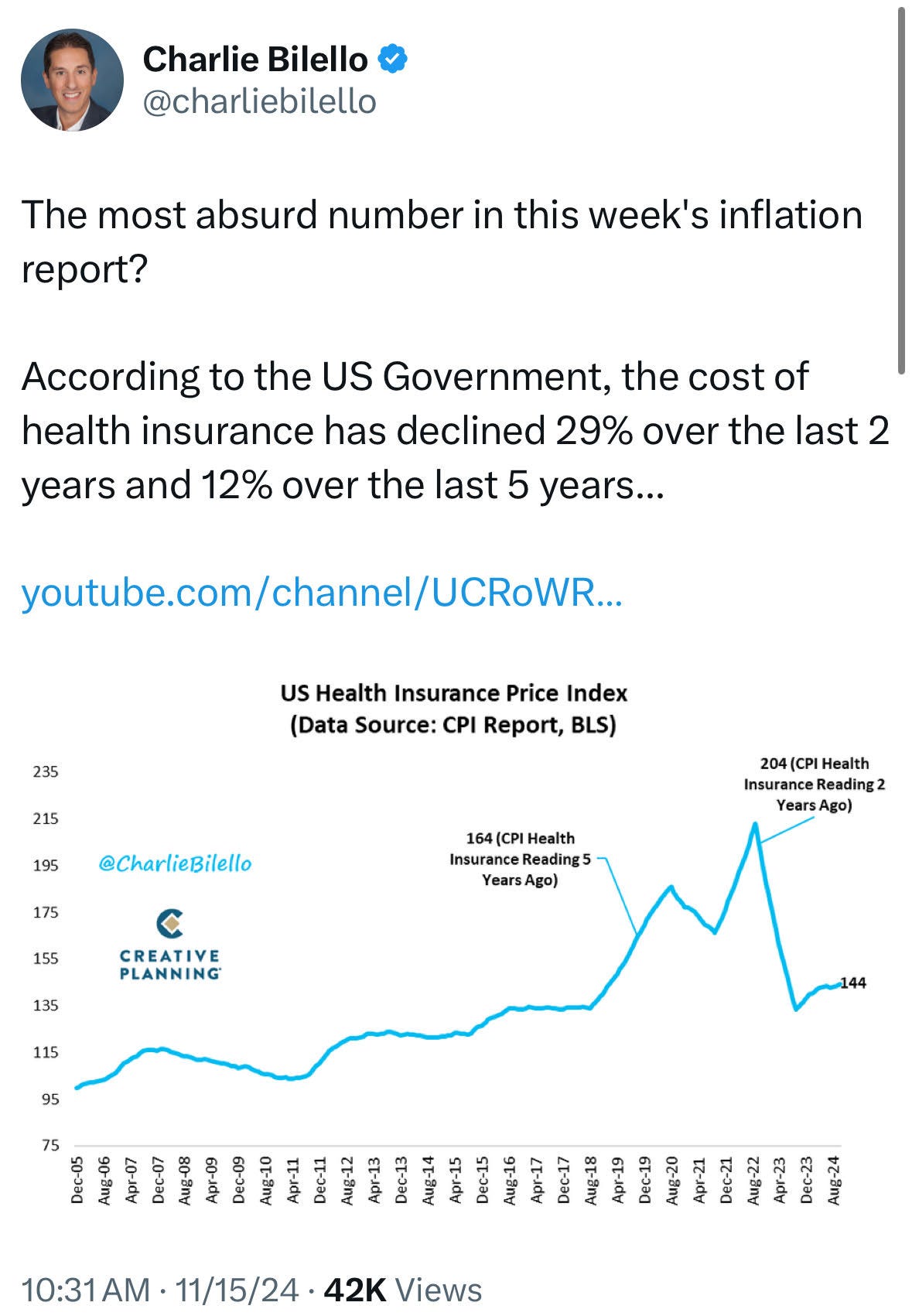

Tweets of the Week

In Case You Missed it…

The David Rubenstein Show: Cal Ripken Jr. (video)

Fmr. TD Ameritrade CEO Joe Moglia on CNBC (video)

Notes from an August 2008 Warren Buffett Interview

Creating a Culture is Critical - by Gene Hoots

Simon Sinek | Building Optimism | Talks at Google (video)

Founders Podcast: #370 The Founder of IKEA: Ingvar Kamprad

Investing by the Books Podcast: #64 Brett Gardner: Buffett's Early Investments

Excess Returns Podcast: Making Sense of Markets in a Post-Election World

If you have not already upgraded your membership…

Avenel Financial Group, a merchant banking and advisory firm located in Charlotte, NC, launched a business venture called the Co/Investor Club. The Co/Investor Club is a community of value-oriented investors that collaborate on investment opportunities and ideas. You are receiving this newsletter because you are a Free or Premium Member of the Co/Investor Club!

Chat with Mike

Whether you’re an executive with investment opportunities or a college student looking to network, we would love to chat with you! Email our Founder, Mike Pruitt, at mp@coinvestorclub.com with questions and ideas or schedule a meeting.

Don’t forget to follow us on social media too!

Twitter: @coinvestorclub1

LinkedIn: Co/Investor Club

For our disclaimer, please visit our website.

Have friends that want to join? The Co/Report is public, so feel free to share!

Thank you for reading. Co/Report grows through word of mouth. Please consider sharing this post with someone who might appreciate it.