Morsels

“When done well, investing involves learning how to process information in order to determine when the odds are in your favor; the goal is to make educated bets based on facts and not stories. In investing, and in life for that matter, you can’t choose outcomes, but you can choose the decisions that may get you the outcomes you want.” —Todd Combs

Stock markets closed the first week of the 3rd quarter in negative territory. The S&P 500 fell 1.16%, the Nasdaq was down 0.92%, and the Dow had the largest loss among the major U.S. indices, falling 1.96% during the holiday-shortened week.

One of the big company-specific news items this week was Meta’s launch of Threads, its competitor—some might say clone—to Twitter. It apparently had 70 million sign-ups just a day after launching, largely thanks to its integration with Meta-owned Instagram.

We have no idea whether Threads will be long-term successful or displace Twitter. Network effects are tough to crack, and the odds are likely on Twitter being around for a long time.

But we find the story of Meta, the stock, a wonderful example of Mr. Market’s fickleness.

Last fall, around the time we mentioned that maybe, just maybe, a little too much pessimism was possibly being priced into the company’s market value, the company’s stock hit a low of $88.09 per share on November 4, 2022. On Thursday of this past week, the stock touched $298.12 before closing the week at $290.53.

When the stock was hated, it seems a contrarian view would have been: “At this price, the stock is trading around a P/E ratio of less than ten times the peak earnings of the businesses which are still there and growing, albeit barely growing, but competitively-advantaged. Management has made some great capital allocation decisions in the past that people thought were dumb when they made them. Maybe the investments in the Metaverse and AI will pay off. Maybe they won’t. But the core businesses are profitable and eventually, given management’s history and incentives, more capital discipline will come back when the future is a little clearer.”

As complicated as the Metaverse, AI, and the future of the internet may have been to figure out then and now, at the right price, when the important things can be understood even in the midst of uncertainty, a simple thesis is often all it takes.

Todd Combs discussed this topic in his introduction to Part IV of the seventh edition of Security Analysis, and we’ll end this section with his words since he says it better than we can:

In attempting to value companies over my career, I’ve come to appreciate that the difference between a good analyst and a great one lies in the ability to keep things simple and determine what matters most. People misinterpret this to mean that investors should keep things at the surface level. In fact, it paradoxically takes a great deal of depth to stay simple. The analyst’s job is to tear apart an investment in order to understand its essential elements. A great security analyst is willing to rip a company down to its studs and understand each part before they reassemble it. In the massive sea of information that an analyst is continuously ingesting, there is always one piece that matters more than the others. Finding that morsel is what keeping it simple means.

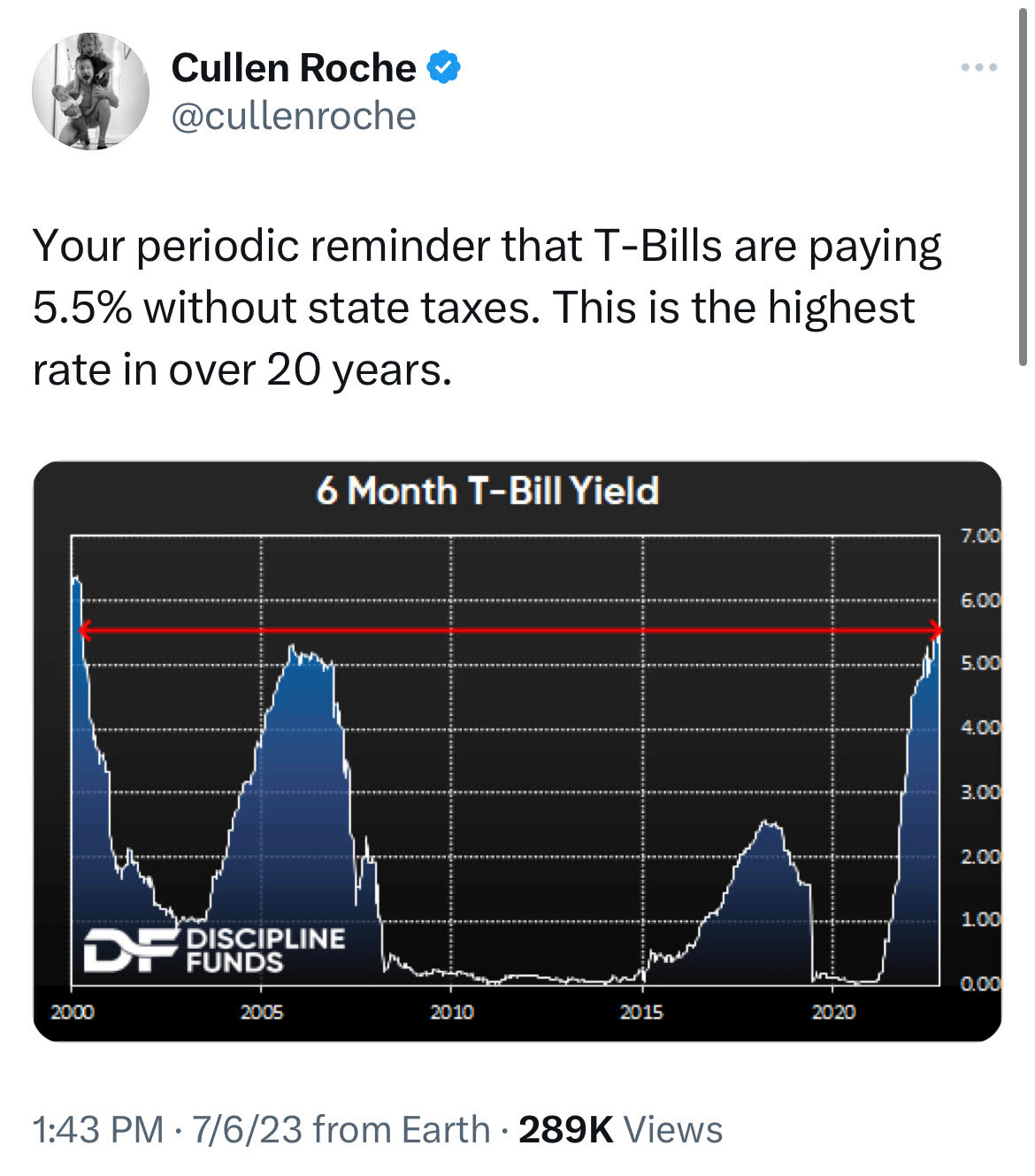

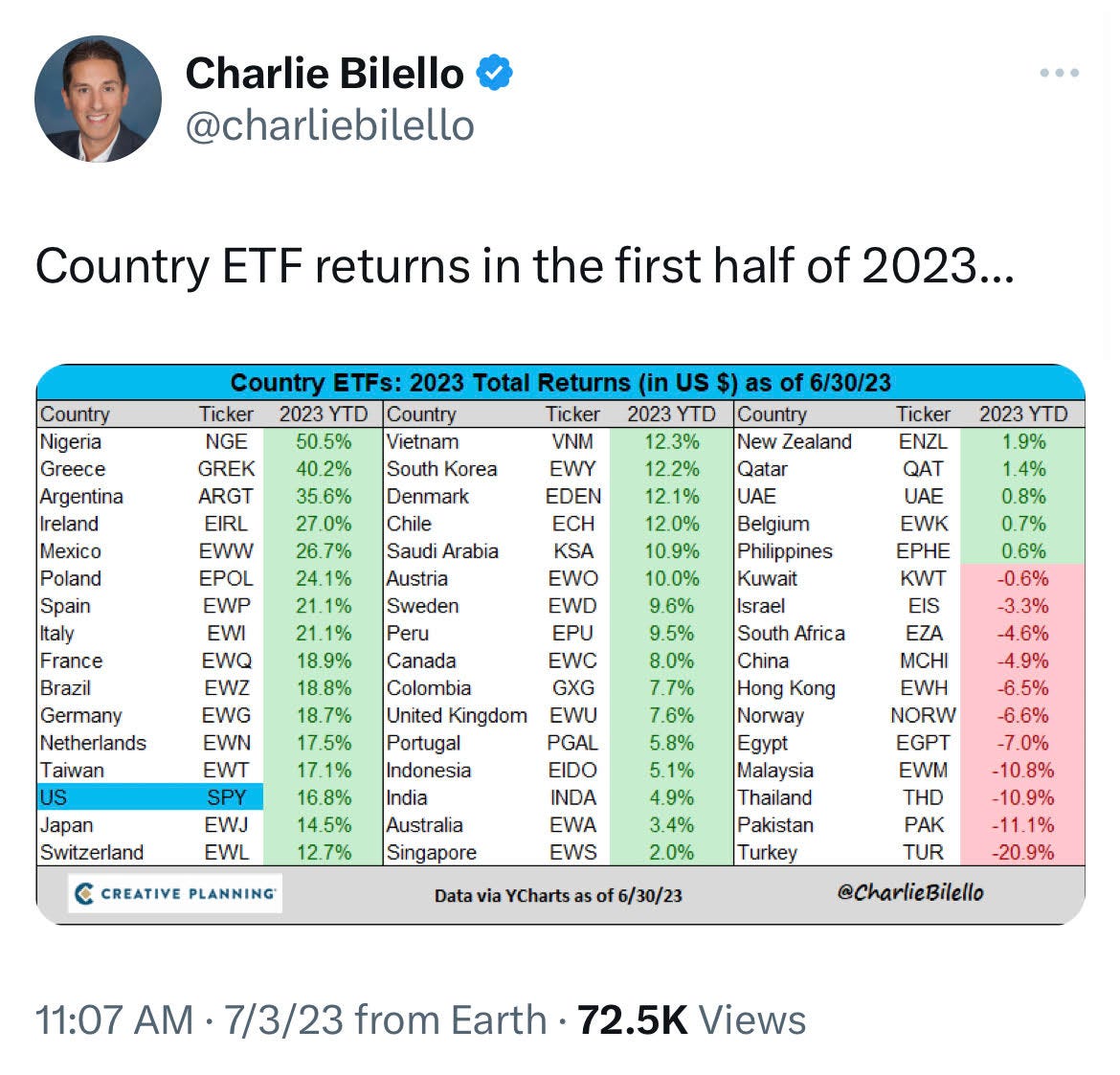

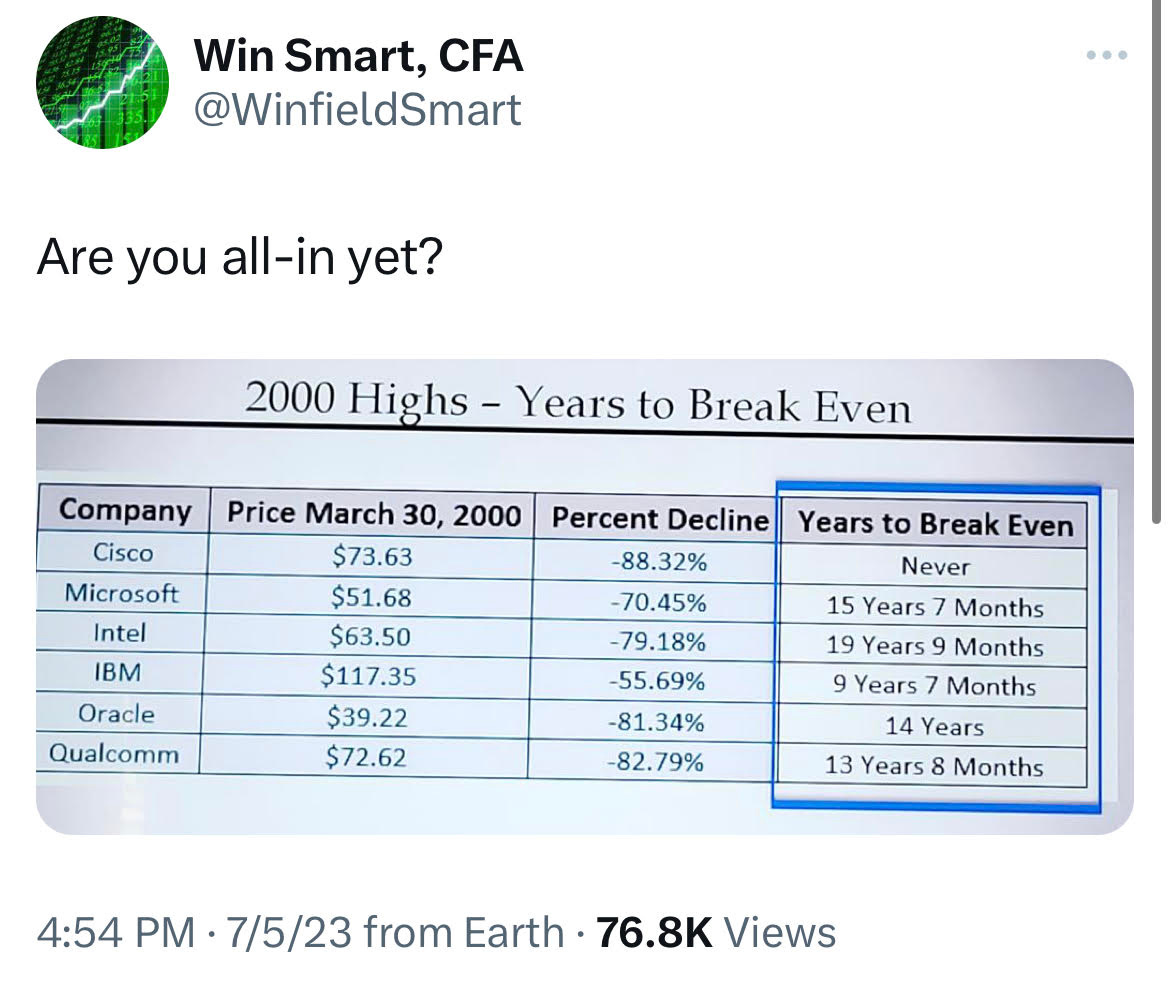

Tweets of the Week

In Case You Missed it…

Microcap Investing Masterclass & Finding 'Lightning in a Bottle' w/ Ian Cassel (video)

Restaurateur Danny Meyer explains why he ended the no-tipping policy at his restaurants (video)

Broyhill Book Club: Summer 2023

Odd Lots Podcast: Bridgewater’s Greg Jensen on AI, Inflation and What Markets Are Getting Wrong

The Business Brew Podcast: Derek Pilecki - A Financials Specialist

The Knowledge Project Podcast: #170: TKP Insights: Philosophy

If you have not already upgraded your membership…

Avenel Financial Group, a merchant banking and advisory firm located in Charlotte, NC, launched a new business venture called the Co/Investor Club. The Co/Investor Club is a community of value-oriented investors that collaborate on investment opportunities and ideas. You are receiving this newsletter because you are a Free or Premium Member of the Co/Investor Club!

Chat with Mike

Whether you’re an executive with investment opportunities or a college student looking to network, we would love to chat with you! Email our Founder, Mike Pruitt, at mp@coinvestorclub.com with questions and ideas or schedule a meeting.

Don’t forget to follow us on social media too!

Twitter: @coinvestorclub1

LinkedIn: Co/Investor Club

For our disclaimer, please visit our website.

Have friends that want to join? The Co/Report is public, so feel free to share!

Thank you for reading. Co/Report grows through word of mouth. Please consider sharing this post with someone who might appreciate it.