Investor Education: 401 (K) and 403 (B) Plans

401(k) and 403(b) plans are employer-sponsored retirement plans that allow employees to save and invest for their future. The main difference between these two plans is that for-profit companies offer the 401(k) plan, while the 403(b) plan is provided by non-profit and specific tax-exempt organizations- schools, hospitals, etc.

Read our Overview on 401 (K) and 403 (B) Plans Here!

Shiny Objects

The January Effect was in good form in 2023. This past week, the markets closed out the first month of the year, with the S&P 500 up over 6% in January, and the Nasdaq leading the way with a gain close to 11%. After being the big loser last year, the Nasdaq has been up for five straight weeks, with further gains to begin the month of February.

Speculation seems to have returned to parts of the market—at least for now. On little-to-no news, some of the growth darlings from 2020-early 2021 that crashed in 2022, and faced potential bankruptcy rumors, have rallied hard to start 2023. As one of many potential examples, Carvana is up over 200% this year.

What to make of it all? We don’t know. Markets are fickle, and people are even more so. They like a certain shiny object one day, and then another the next day, and then the first one again, and on it goes. Stocks are the shiny objects of speculators—some of whom admit to being so, and some of whom think they’re investing rather than speculating.

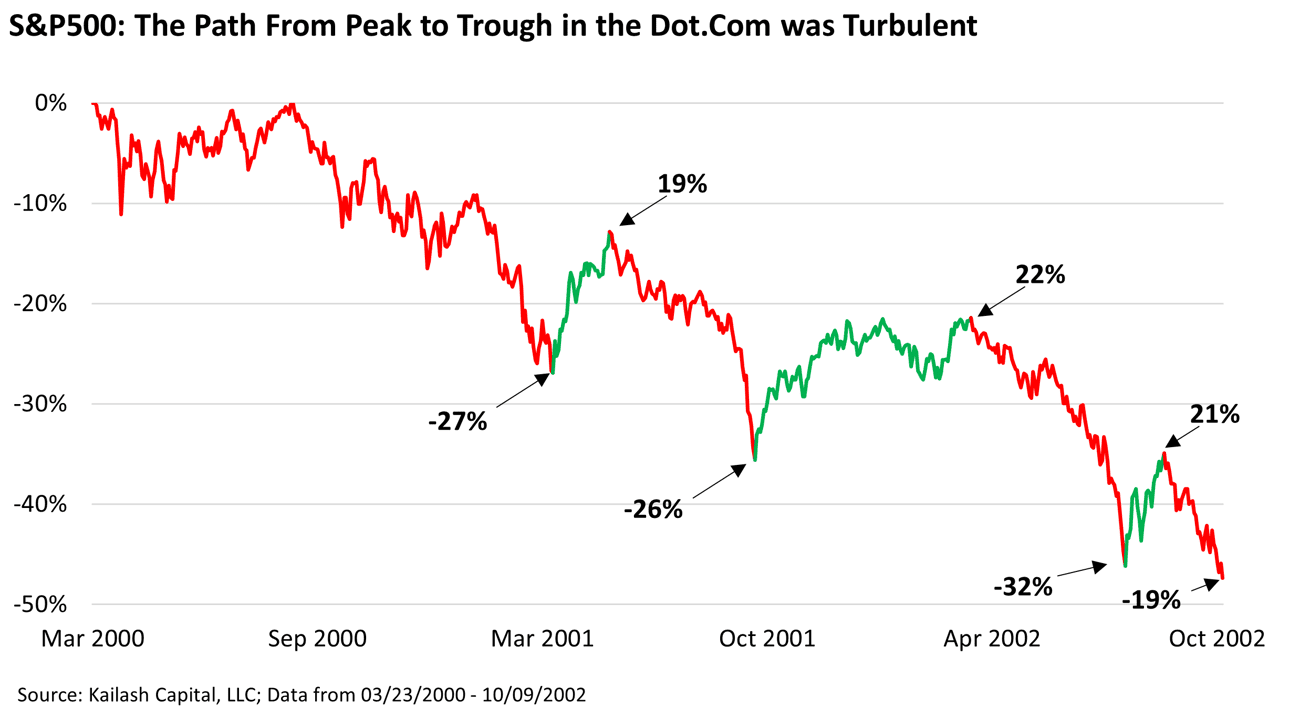

The breaking of the great bubbles is usually volatile and takes a little time. Kailash Concepts Research shared the chart below in a newsletter that sums this up well, using the 2000 stock market bubble bursting as the example:

Whether the popping of that bubble will resemble the current version is anyone’s guess. Or maybe the worst is behind us?

Historical valuation extremes like we saw in 2021 tend to unwind more severely and painfully in a broad index like the S&P 500 than we’ve seen thus far. But many technology stocks—where extremes were most rampant—have seen more pain. And many value stocks have seen no pain at all.

As always, it pays to pick your spots.

“Men, it has been well said, think in herds; it will be seen that they go mad in herds, while they only recover their senses slowly, and one by one.” —Charles Mackay

Tweets of the Week

In Case You Missed it…

Amergent Hospitality Closes $2.5 Million Financing

Everything You Can’t Have - by Morgan Housel

Disagreements and First Principles: The Pushback on my Tesla Valuation - by Aswath Damodaran

Why VR/AR Gets Farther Away as It Comes Into Focus - by Matthew Ball

Practice Different - by Stephen Vafier

Permanent Podcast: Shane Parrish: Why Discipline Doesn’t Matter

Masters in Business Podcast: William D. Cohan on M&A Investment

If you have not already upgraded your membership…

Avenel Financial Group, a merchant banking and advisory firm located in Charlotte, NC, launched a new business venture called the Co/Investor Club. The Co/Investor Club is a community of value-oriented investors that collaborate on investment opportunities and ideas. You are receiving this newsletter because you are a Free or Premium Member of the Co/Investor Club!

Chat with Mike

Whether you’re an executive with investment opportunities or a college student looking to network, we would love to chat with you!Email our Founder, Mike Pruitt, at mp@coinvestorclub.com with questions and ideas or schedule a meeting.

Don’t forget to follow us on social media too!

Twitter: @coinvestorclub1

LinkedIn: Co/Investor Club

For our disclaimer, please visit our website.

Have friends that want to join? The Co/Report is public, so feel free to share!

Thank you for reading. Co/Report grows through word of mouth. Please consider sharing this post with someone who might appreciate it.