Mood Swings

After a down first few trading days to the month, the markets once again continued their comeback with another positive week—which ended with Federal Reserve Chair Jerome Powell bringing the much-anticipated news that Fed rate cuts would begin soon, and likely next month. For the week, the S&P 500 was up about 1.45%, the Nasdaq was up 1.4%, and the Dow rose about 1.3%.

August has been a month of mood swings in the market. Many months in the market are like that, although not many begin as volatile and reverse as quickly as this one. Howard Marks touched on this point in a memo he released last week:

Mood swings do a lot to alter investors’ perception of events, causing prices to fluctuate madly. When prices collapse as they did at the start of this month, it’s not because conditions have suddenly become bad. Rather, they become perceived as bad. Several factors contribute to this process:

heightened awareness of things on one side of the emotional ledger,

a tendency to overlook things on the other side, and

similarly, a tendency to interpret things in a way that fits the prevailing narrative.

What this means is that in good times, investors obsess about the positives, ignore the negatives, and interpret things favorably. Then, when the pendulum swings, they do the opposite, with dramatic effects.

And that about sums it up. The issues with the yen carry trade and some weak economic reports in the U.S. caused the narrative to skew negative until a new, more positive narrative—and Mr. Market always prefers a positive narrative—was formed about lower inflation and rate cuts to drive investor psychology back to a happy euphoria.

No one knows what may cause the next swing in investor mood. But just like there were some (very brief) opportunities to find bargains earlier this month, the next swing will likely also present some opportunities for those who are prepared.

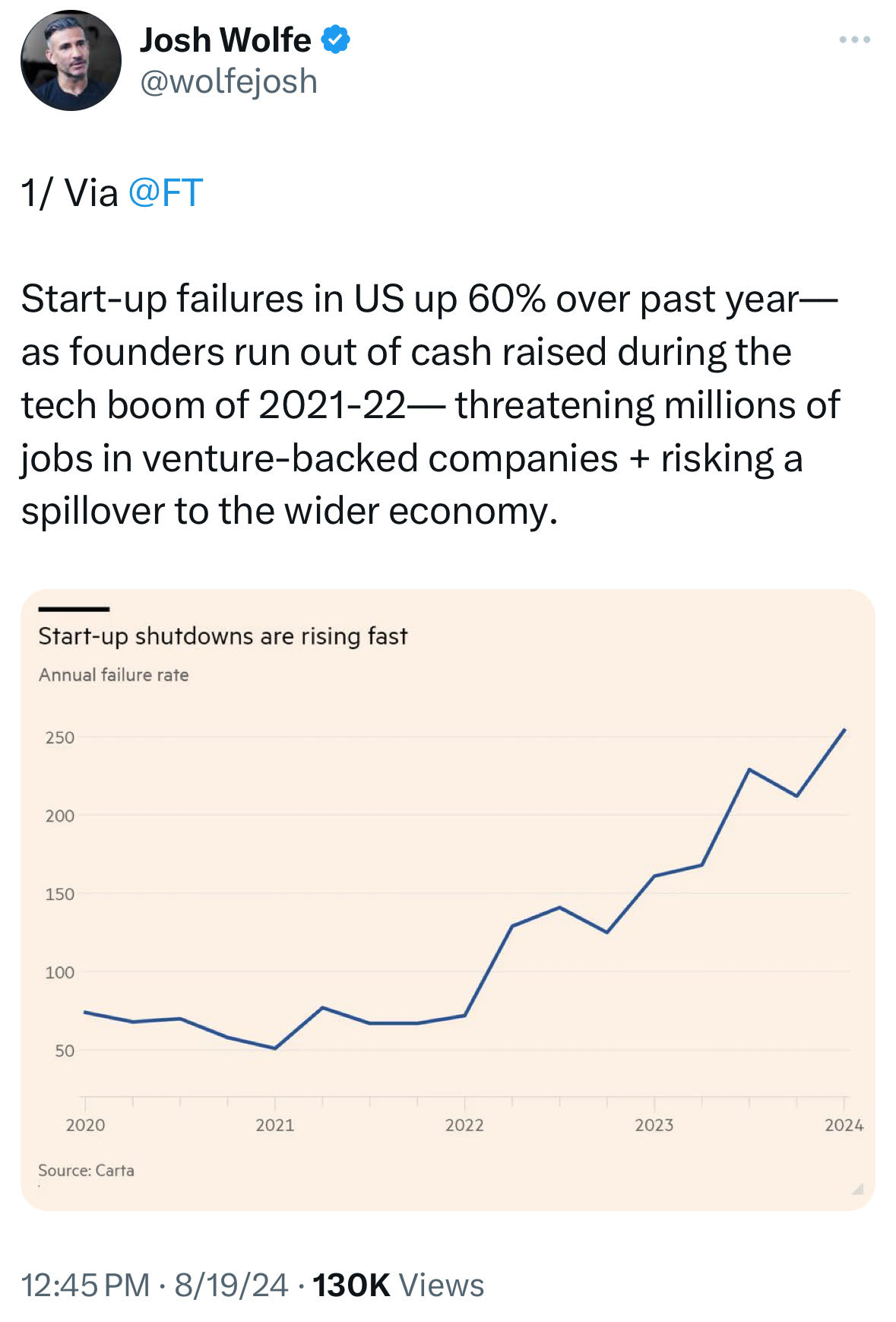

Tweets of the Week

In Case You Missed it…

Mr. Market Miscalculates - by Howard Marks

The Skills of Stock Picking by Ian Cassel (video)

Warren Buffett on investing and selling

The Business Brew Podcast: Richard Cook - Traversing For Value

If you have not already upgraded your membership…

Avenel Financial Group, a merchant banking and advisory firm located in Charlotte, NC, launched a business venture called the Co/Investor Club. The Co/Investor Club is a community of value-oriented investors that collaborate on investment opportunities and ideas. You are receiving this newsletter because you are a Free or Premium Member of the Co/Investor Club!

Chat with Mike

Whether you’re an executive with investment opportunities or a college student looking to network, we would love to chat with you! Email our Founder, Mike Pruitt, at mp@coinvestorclub.com with questions and ideas or schedule a meeting.

Don’t forget to follow us on social media too!

Twitter: @coinvestorclub1

LinkedIn: Co/Investor Club

For our disclaimer, please visit our website.

Have friends that want to join? The Co/Report is public, so feel free to share!

Thank you for reading. Co/Report grows through word of mouth. Please consider sharing this post with someone who might appreciate it.