Equally Insane

The S&P 500 and Nasdaq both saw gains during the holiday-shortened week, with the S&P 500 rising about 2% and the Nasdaq up about 3.5%. Both indices ended the week at record highs.

This past week, Oaktree Capital also released some audio from its 2024 client conference, including these comments from Howard Marks:

I believe that the 2,000-basis-point decline [since 1980] was the most important single financial event in the last half-century—not the bankruptcy of Lehman, not the meltdown of the tech bubble, or black Monday. This was really important, but I think few people recognize it as such because it took so long, and occurred so gradually.

…We think that if the easy money period is over, there may be a number of consequences. We think economic growth may be slower. Profit margins may erode. Investor psychology may not be as uniformly positive as it was in the period of declining rates. Ownership interest may not appreciate as reliability—declining rates cause an asset bubble, and we’ve had one. The cost of borrowing will not trend down consistently. Leverage is unlikely to add as much to returns as it did in that salutary period. Businesses may not find it as easy or inexpensive to attain financing. And default rates may head higher.

And we believe strongly that these things are the case, especially the latter six which are more investment characteristics than economics.

…Einstein defined insanity as doing the same thing over and over again and expecting a different result. But I think it’s equally insane to do the same thing in a different environment and expect the same result.

And if the coming environment is going to be different—as we believe—I think that the things that succeeded best in the period of low and declining rates will not succeed as well in the coming years.

If you agree that the environment is going to be different going forward and that the long period of declining rates that ended a couple of years ago is still in the early stages of seeing its effects on markets trickle down, then it’s as good a time as any to ask yourself if you, your portfolio, and your lifestyle are ready for it.

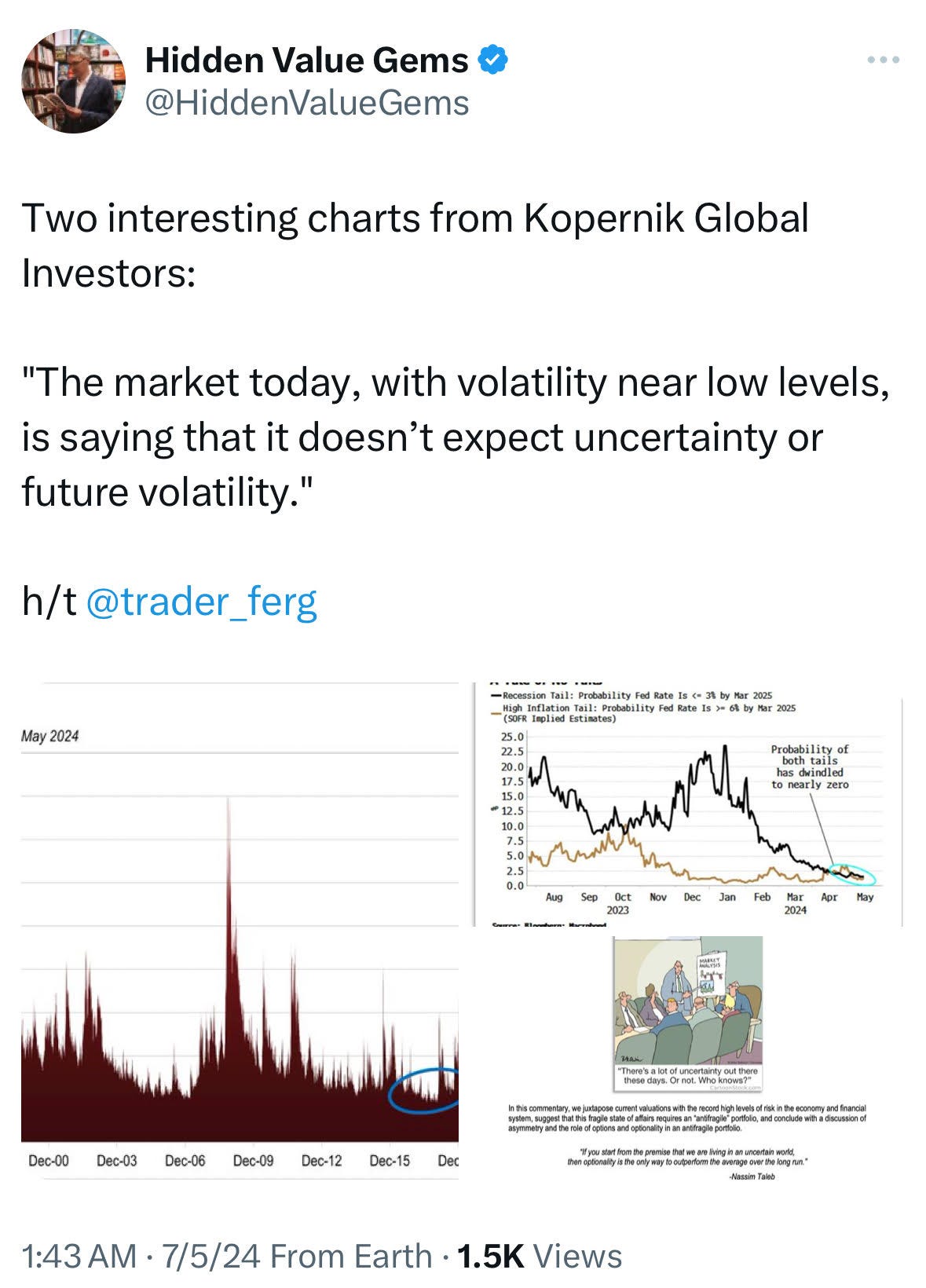

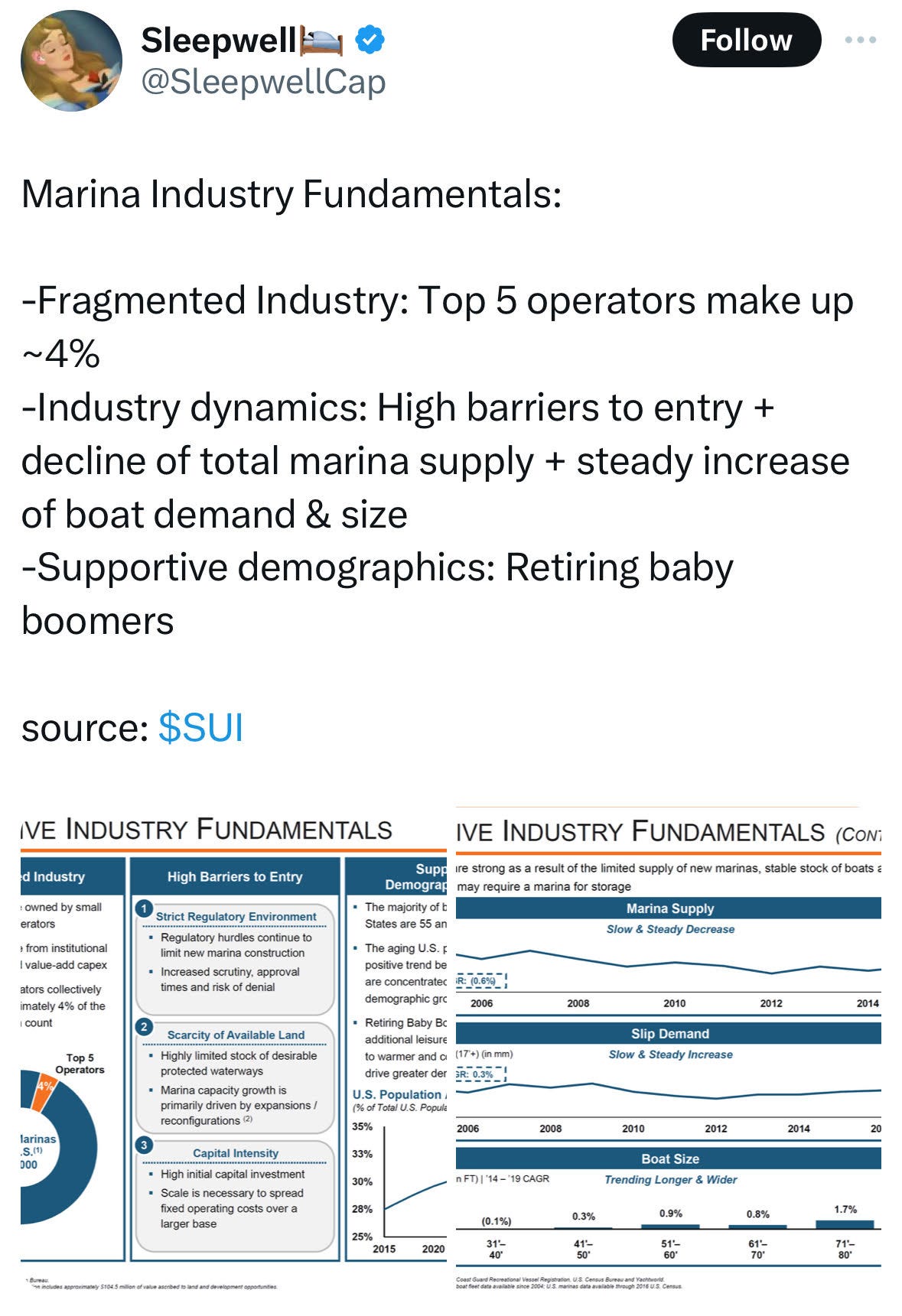

Tweets of the Week

In Case You Missed it…

J.P. Morgan Asset Management’s 3Q Guide to the Markets

GMO Quarterly Letter | FAQ: Passive Investing

How Brad Jacobs Will Invest $4.5 Billion to Reshape Building Supplies (video)

'Never Enough' — From Barista To Billionaire | Andrew Wilkinson (video)

Invest Like the Best Podcast: Modest Proposal - AI Commoditization and Capital Dynamics

Founders Podcast: #355 Rare Bernard Arnault Interview

An Update From Our Friends at Splash Wine:

Splash Wines, Inc. is pleased to notify our shareholders, suppliers and related parties that, effective last month, we have merged significant of the Company’s assets with Full Glass Wine Company which owns several other entities in the direct-to-consumer wine business including Winc, Wine Insiders and Bright Cellars.

Under the terms of the deal, the Splash and Wine Awesomeness brands will migrate to Full Glass, making that entity one of the largest companies in the US direct-to-consumer wine business with a clear path to continue to grow into a position of dominance in the next few years.

In accordance with the terms of the Asset Purchase Agreement, Splash will receive a total of $13.6M in cash, seller notes, assignment of payables, inventory assumption and stock in Full Glass. Eight members of the Splash team will become employees at Full Glass, responsible for helping that company achieve its goals and, in turn, create additional value for Splash shareholders.

In a related transaction, the company has agreed to acquire CellarStash Wine Marketplace, Inc in a non-cash transaction. On that basis and effective immediately, Splash will change its name to CellarStash, Inc. No other organizational changes to CellarStash are contemplated as part of this transaction and CellarStash will continue to market Vine Oh! and manage relationships with Rue La La and QVC, with a focus on business-to-business opportunities.

Management believes the new structure will be very positive for CellarStash. Not only do we have an ownership interest in Full Glass and the opportunity for a liquidity event with that entity, but CellarStash will now be able to focus on some exciting new projects with projected profitability from day one—which means two liquidity opportunities for our shareholders.

With the fiscal year ending on June 30, management expects to provide you with updated financial reports in the next month and we are also expecting to be able to make some significant announcements in the coming weeks regarding the reorganization of the company and various other projects.

We are excited about the opportunities and challenges associated with both the Full Glass and CellarStash transactions. Management appreciates the confidence and support of our shareholders as we continue to evolve and grow our value.

As advised, you will be hearing a lot more from us in the next months as the process evolves but feel free to reach out to me anytime you have any interim questions.

Thanks for your patience and understanding.

Robert Imeson

CEO, CellarStash, Inc

If you have not already upgraded your membership…

Avenel Financial Group, a merchant banking and advisory firm located in Charlotte, NC, launched a business venture called the Co/Investor Club. The Co/Investor Club is a community of value-oriented investors that collaborate on investment opportunities and ideas. You are receiving this newsletter because you are a Free or Premium Member of the Co/Investor Club!

Chat with Mike

Whether you’re an executive with investment opportunities or a college student looking to network, we would love to chat with you! Email our Founder, Mike Pruitt, at mp@coinvestorclub.com with questions and ideas or schedule a meeting.

Don’t forget to follow us on social media too!

Twitter: @coinvestorclub1

LinkedIn: Co/Investor Club

For our disclaimer, please visit our website.

Have friends that want to join? The Co/Report is public, so feel free to share!

Thank you for reading. Co/Report grows through word of mouth. Please consider sharing this post with someone who might appreciate it.