Brains and Knowledge

“The genuine investor in common stocks does not need a great equipment of brains and knowledge, but he does need some unusual qualities of character.” —Benjamin Graham

Gains on Friday led the S&P 500 and Dow to another record high, and sent the Nasdaq to within 1% of its record high. All three indices gained just shy of 1% for the week.

During the last thirty years, we’ve seen several major bubbles and busts, yet the S&P 500 has compounded at about 10.8% during that span. If you were disciplined and kept saving and investing, you did very well just buying the market.

There were stocks that did much better than the market and stocks that did much worse. But making double-digit returns without having to do any analysis has been a significant advantage for those who diversified widely and had the fortitude to keep investing and not stray from their plan—even as there were periods when their wealth may have declined by 30% or more during certain stretches of time.

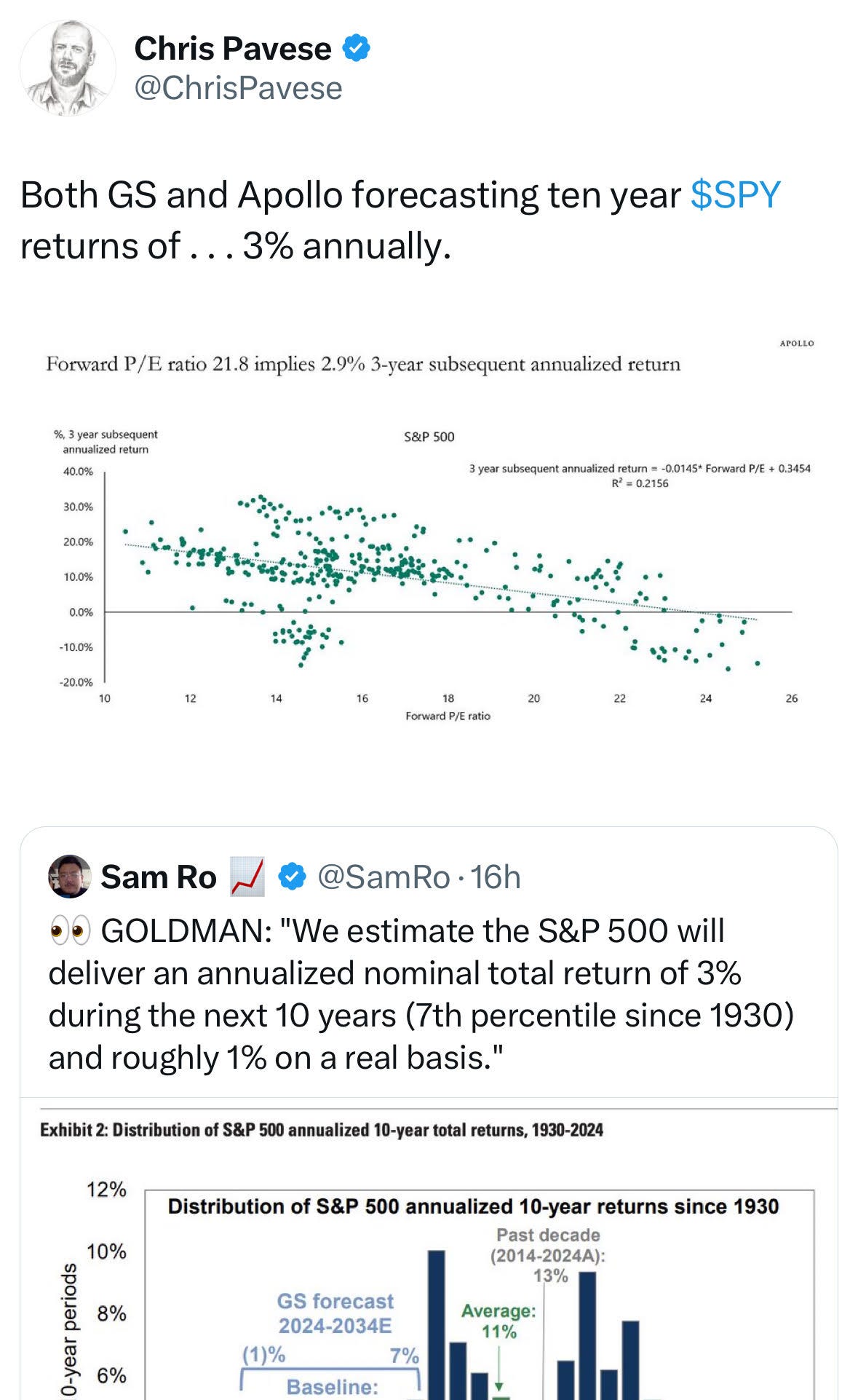

Of course, in a series of data, starting and ending points matter—in this case, especially the ending point. The current high valuations tend to be associated with 10-year nominal returns going forward somewhere between slightly negative per year and positive 3% per year.

That’s not a forecast—just an observation about the past that may or may not be relevant to the future.

But we will forecast that investors who possess discipline, patience, and realism will tend to do better over the long run than those who don’t.

“The most important thing in investments is not having a high IQ, thank God. I mean, the important thing is realism and discipline. And you don’t need to be extraordinarily bright to do well in investments, if you are realistic and disciplined.” —Warren Buffett

Tweets of the Week

In Case You Missed it…

Measuring the Moat - by Michael Mauboussin & Dan Callahan

Letter from Ron Baron | Q3 2024

Rob Fraser: How I Quit Sports and Built a $10M Business (video)

Invest Like the Best Podcast: Matt Perelman & Alex Sloane - The Art of Franchise Investing

The Startup Ideas Podcast: 6 startup ideas from the tech Warren Buffett

Guy Kawasaki’s Remarkable People Podcast: Seth Godin: Transforming Ideas into Impactful Strategies

Rivemont MicroCap Fund- Interview with Mathieu Martin (Youtube)

If you have not already upgraded your membership…

Avenel Financial Group, a merchant banking and advisory firm located in Charlotte, NC, launched a business venture called the Co/Investor Club. The Co/Investor Club is a community of value-oriented investors that collaborate on investment opportunities and ideas. You are receiving this newsletter because you are a Free or Premium Member of the Co/Investor Club!

Chat with Mike

Whether you’re an executive with investment opportunities or a college student looking to network, we would love to chat with you! Email our Founder, Mike Pruitt, at mp@coinvestorclub.com with questions and ideas or schedule a meeting.

Don’t forget to follow us on social media too!

Twitter: @coinvestorclub1

LinkedIn: Co/Investor Club

For our disclaimer, please visit our website.

Have friends that want to join? The Co/Report is public, so feel free to share!

Thank you for reading. Co/Report grows through word of mouth. Please consider sharing this post with someone who might appreciate it.