Fortune Cookies

SPECIAL ANNOUNCEMENT:

Goldman Sachs forecasts that the S&P should return only about 3% annually for the next 10 years. Smart money is heading into private equity, private debt and microcaps.

As you have seen with our Co/Investment into Shaq’s Big Chicken, we are transitioning into being ACTIVE Co/Investors with and alongside the best-in-class investors and fund managers in the world.

To participate in these investments and to join us in our live “Lunch at the Club” sessions with top investors, we will be launching our PREMIUM MEMBERSHIP this week - and at a no-brainer launch rate - so keep your eyes open and we look forward to some spectacular opportunities and experiences together moving forward.

“I learned a lot from my favorite fortune cookie: The cautious seldom err or write great poetry. It cuts two ways, which makes it thought provoking. Caution can help us avoid mistakes, but it can also keep us from great accomplishments.” —Howard Marks

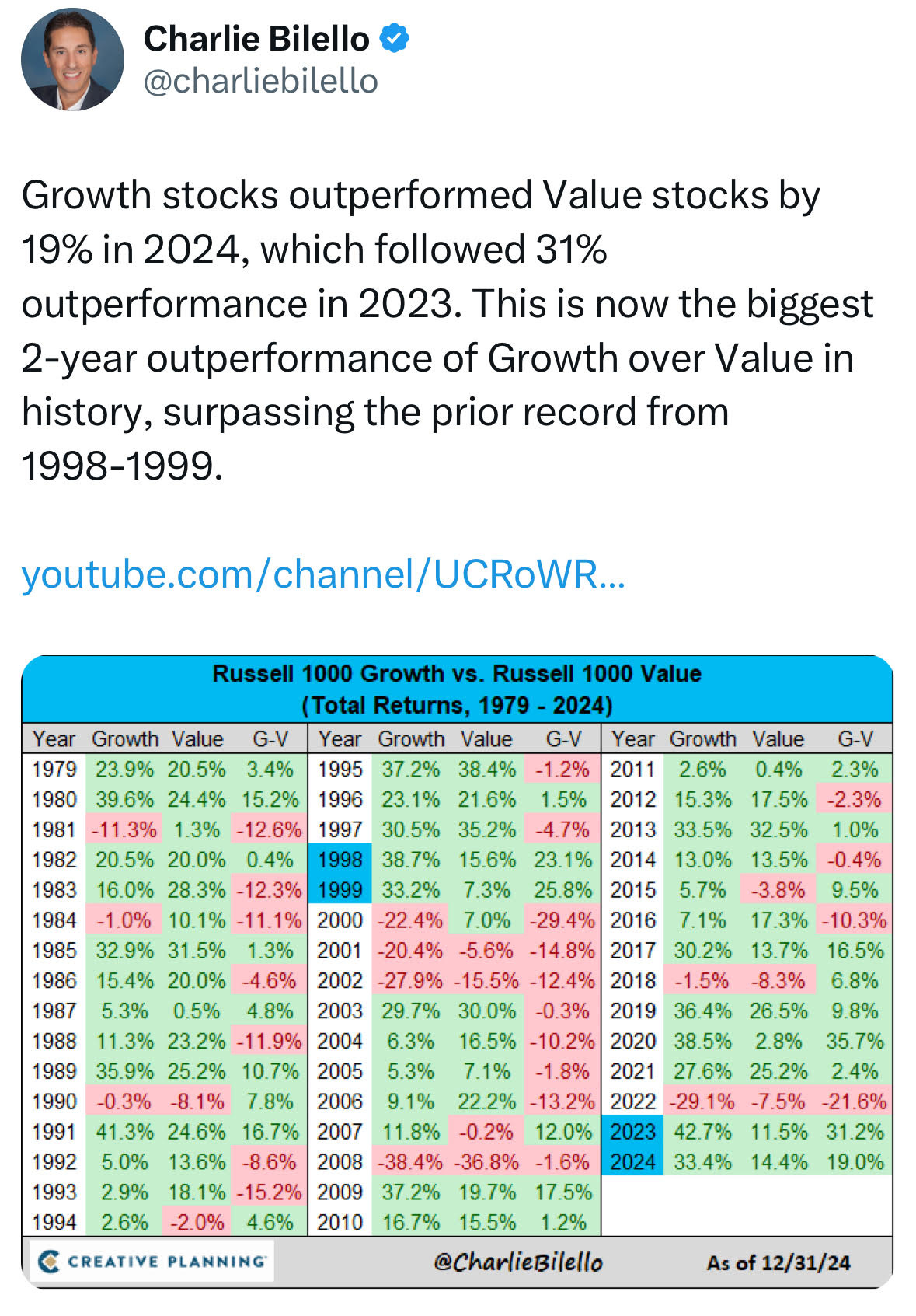

The New Year is officially upon us—and what a year 2024 was for the stock market. The S&P 500 ended the year up 23.3%, which followed a rise of 24.2% in 2023. The Dow was up 12.9% in 2024 after rising more than 13% in 2023. And the Nasdaq was once again the big winner, rising 28.6% during the year after increasing more than 43% during 2023.

After a tough 2022, patience has rewarded those who stayed invested and stayed long the stock market indices. Big tech has continued to lead the way, although there were plenty of winners—for example, Berkshire Hathaway posted its 9th up year in a row after gaining 25.5% during 2024.

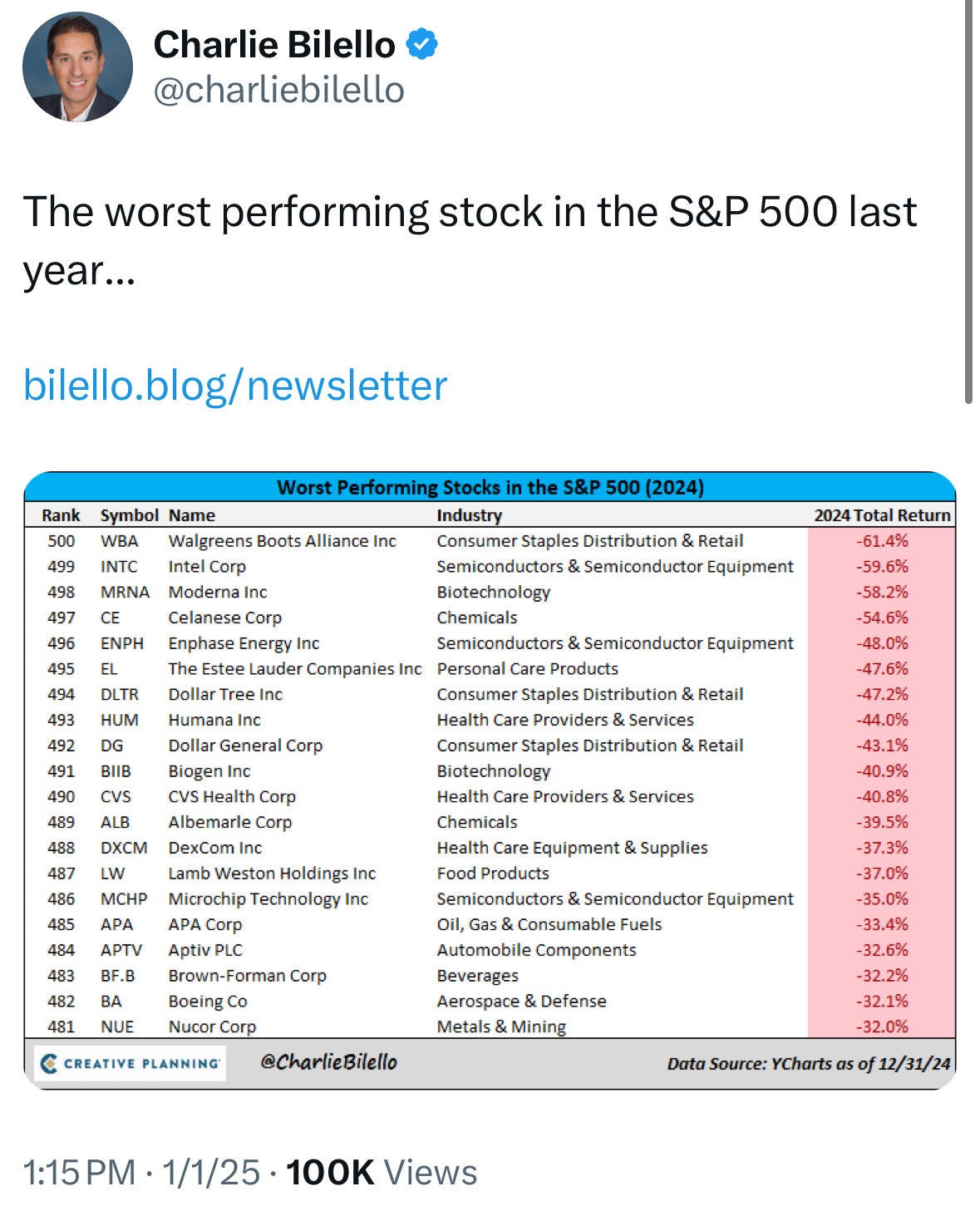

And there were plenty of losers, too:

Some of those are likely beaten down too much. And some of those are likely falling knives that might not be worth catching. Volatility creates opportunities to make money, as well as mistakes.

But mistakes are okay so long as they aren’t big enough to put you out of the game. You can learn and move on to fight another day—assuming you’re still in the fight.

Happy New Year to all of our readers! We welcome you to 2025 and hope you have a year of profit, good health, and good luck. We have plenty of new things planned this year that we hope you’ll enjoy, and we appreciate you coming along for the ride.

“There’s no way that you can live an adequate life without making many mistakes. Part of what you must learn is how to handle mistakes and new facts that change the odds.” —Charlie Munger

“To others, being wrong is a source of shame; to me, recognizing my mistakes is a source of pride. Once we realize that imperfect understanding is the human condition, there is no shame in being wrong, only in failing to correct our mistakes.” —George Soros

Tweets of the Week

In Case You Missed it…

J.P. Morgan Asset Management’s 1Q Guide to the Markets

This Year in Gas — A look back at the most interesting energy market of 2024

On Leverage - Alix Pasquet’s Presentation at Yale University (video)

Off The Beaten Path Investing: Lawrence J. Goldstein, Santa Monica Partners (video)

The Idea Farm’s Best Podcast Episodes of 2024

Best Stocks 2025: A Conversation with Paul Andreola | Capital Compounders Show (EP #18) (video)

Yet Another Value Podcast: Yet Another Value’s 2025 Idea of the Year: Full House Resorts

The Investor’s Podcast: The Art of Thoughtful Wealth Creation w/ William Green

If you have not already upgraded your membership…

Avenel Financial Group, a merchant banking and advisory firm located in Charlotte, NC, launched a business venture called the Co/Investor Club. The Co/Investor Club is a community of value-oriented investors that collaborate on investment opportunities and ideas. You are receiving this newsletter because you are a Free or Premium Member of the Co/Investor Club!

Chat with Mike

Whether you’re an executive with investment opportunities or a college student looking to network, we would love to chat with you! Email our Founder, Mike Pruitt, at mp@coinvestorclub.com with questions and ideas or schedule a meeting.

Don’t forget to follow us on social media too!

Twitter: @coinvestorclub1

LinkedIn: Co/Investor Club

For our disclaimer, please visit our website.

Have friends that want to join? The Co/Report is public, so feel free to share!

Thank you for reading. Co/Report grows through word of mouth. Please consider sharing this post with someone who might appreciate it.