Microcap investing has long been a domain for quality investors seeking outsized returns. Despite the challenges inherent in the asset class, recent developments underscore its enduring appeal. Prolonged outperformance from many of the investors we highlighted in our Top 50 Microcap Investors series illustrates that when approached with diligence, patience, and a clear framework, microcap investments can continue to generate compelling long-term returns even in a rapidly evolving financial landscape.

Historically, microcap stocks have consistently outperformed their larger-cap peers. In our team’s 2012 Chanticleer Advisors white paper, we presented research showing that companies in the smallest decile of the market capitalization spectrum delivered annualized returns exceeding 12.9%—significantly outpacing the returns of large-cap stocks over the same period.

*Time period is from 1926-2011*

This outperformance was attributed to a combination of structural inefficiencies: lower institutional ownership, limited analyst coverage, and higher levels of insider alignment.

In the years since that research was published, the gap between the market’s most widely held securities and its most overlooked has only widened. The dominance of passive investing and benchmark-driven capital allocation has funneled trillions of dollars into large-cap names, leaving many smaller companies entirely out of index inclusion. As a result, microcaps, due to their size, limited float, and lower liquidity, are frequently excluded from institutional mandates and remain off the radar of ETFs and quantitative strategies.

And attempts to index the microcap space present a set of challenges that make broad benchmarks less representative than they appear. Common indices, such as the Russell Microcap, iShares Micro-Cap ETF, and CRSP US Micro Cap Index, often include companies that are no longer true microcaps, either due to market cap drift or a methodology that favors liquidity over strict size constraints. These benchmarks are also skewed by a high proportion of unprofitable or speculative businesses, particularly in healthcare and biotech, which may not accurately reflect the broader opportunity set. Alternative efforts, such as the MCC Profitable Index, aim to refine this by focusing on companies with a market capitalization of under $500 million and positive earnings; however, they are limited by their scope, concentrating solely on the club’s profiled firms.

These structural blind spots create persistent inefficiencies that cannot be easily arbitraged away. Without the constant price discovery mechanisms that operate in more liquid markets, mispricings in the microcap space can linger for extended periods. For investors willing to do the legwork, conducting primary research, engaging with management, and underwriting business quality, the payoff often hinges on patience. The value may be apparent to those who look closely, but market recognition typically arrives only after a tangible inflection point: a shift in earnings trajectory, the launch of a new product, an improvement in capital structure, or the mere passage of time as fundamentals compound. This is the essence of time arbitrage—where the edge lies not in faster information, but in a longer time horizon.

To be clear, the space is not without its risks. The microcap universe is vast and uneven; for every high-quality, overlooked business, there is a proliferation of pretenders: companies with weak fundamentals, promotional management teams, and, in some cases, outright fraud. Illiquidity, volatility, and governance issues are common, and investors must also contend with hacks, financial engineering, and businesses that were never built to withstand the test of time.

The necessary due diligence is often far more intensive than a quick screen or valuation exercise. As Bares Capital articulates, their investment success hinges on “differentiated inputs and insights”. Their team “spends more time in boots than in books,” underscoring a philosophy of investing that draws on management engagement and a firsthand understanding of a company’s operating ecosystem. This approach doesn’t just lead to better-informed investment theses, it often reveals crucial dislocations between perception and reality before they are reflected in the price.

Cedar Creek Partners’ work on Propel Holdings offers a glimpse into the meticulous, often unglamorous research process required to build conviction in the microcap space. Because Propel trades on the Expert Market, traditional financial disclosures are limited, and access to timely, standardized data is minimal. They had to reconstruct the company’s financial picture by manually extracting information from scattered and obscure sources, including regulatory filings and industry disclosures. This level of analysis required modeling loan book performance, cash flow dynamics, and credit quality metrics to assess their financial health. A process that more closely resembles private equity-style investigative work than conventional public equities research.

This parallel is more than stylistic. Microcap investing, like private equity, is fundamentally long-term in nature. Both rely on patient capital, rigorous due diligence, and the willingness to look past short-term market fluctuations in favor of underlying business quality and strategic execution. Success in either space depends on identifying companies with strong fundamentals, capable management, and the capacity to reinvest for growth. Boston Partners has noted that actively managed microcap strategies can even outperform private equity over time, citing more attractive entry valuations and less reliance on leverage. What sets microcaps apart, however, is their accessibility. While private equity investors are locked into multi-year holding periods, microcap investors benefit from the liquidity of public markets, offering the rare combination of long-horizon investing with the flexibility to adjust as new information emerges.

But this accessibility is both a gift and a curse. The ability to trade in and out of positions at will can lead to a temptation toward short-termism, undermining the very advantages that a long-horizon approach provides. Too often, stocks with long-term potential are discarded after a few quarters of disappointing headlines or lackluster momentum, not because the thesis is flawed, but because patience is lacking. Successful microcap investing requires the discipline to endure volatility, to hold when the narrative cools, and to add when prices diverge from fundamentals. It also requires self-awareness to avoid crowd behavior and resist the urge to chase returns in more visible parts of the market. In a world where capital moves faster than ever, the willingness to move slowly—and with conviction—can be the edge.

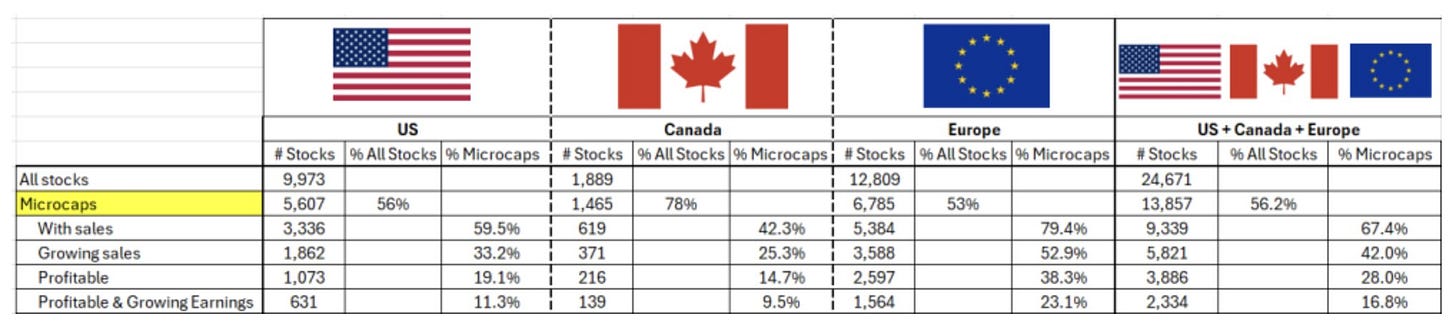

Source: Ian Cassel X

The international microcap space is becoming an increasingly attractive hunting ground for value—and growth-oriented investors. As visuals like Ian Cassel’s recent chart highlight, only a small percentage of these companies are both profitable and growing. Since early 2022, capital markets have been particularly unkind to unprofitable businesses, with many resorting to capital raises under highly dilutive terms. This has created a widening gap between U.S. microcaps and international firms, where investor awareness, disclosure quality, and capital access still vary widely.

Take India, for example—its Nifty Microcap 250 index captures a vibrant, fast-growing segment of the market that benefits from tailwinds such as digital infrastructure, a rising consumer class, and favorable demographics. Many of these businesses remain underfollowed despite strong fundamentals and long growth runways. In Europe, by contrast, the story is often one of deep value. A multitude of small public companies trade at persistently low multiples, in part due to limited liquidity and investor fatigue in stagnant economies. Yet for bottom-up investors willing to sift through fragmented disclosures and varying accounting standards, the EU presents no shortage of overlooked, cash-flow-positive businesses with generationally low valuations. Whether in developed markets or emerging ones, international microcaps increasingly offer the kind of asymmetric return profiles that have become harder to find in the more thoroughly mined U.S. market.

In a world of increasingly efficient markets, the microcap space remains one of the last true frontiers of discovery. It rewards patience, process, and originality—and punishes passivity. At Co/Investor Club, we invest alongside the best, and today marks the first day of the Planet MicroCap Showcase. Planet Microcap, in partnership with the Microcap Club, has brought together 400+ investors attending and 80+ companies in one of the largest events of its kind. We are eager to hear about the best ideas presented and, hopefully, add one or two undervalued companies to our portfolio.